- Gold looks set to hit a new six-year high above $1,520.

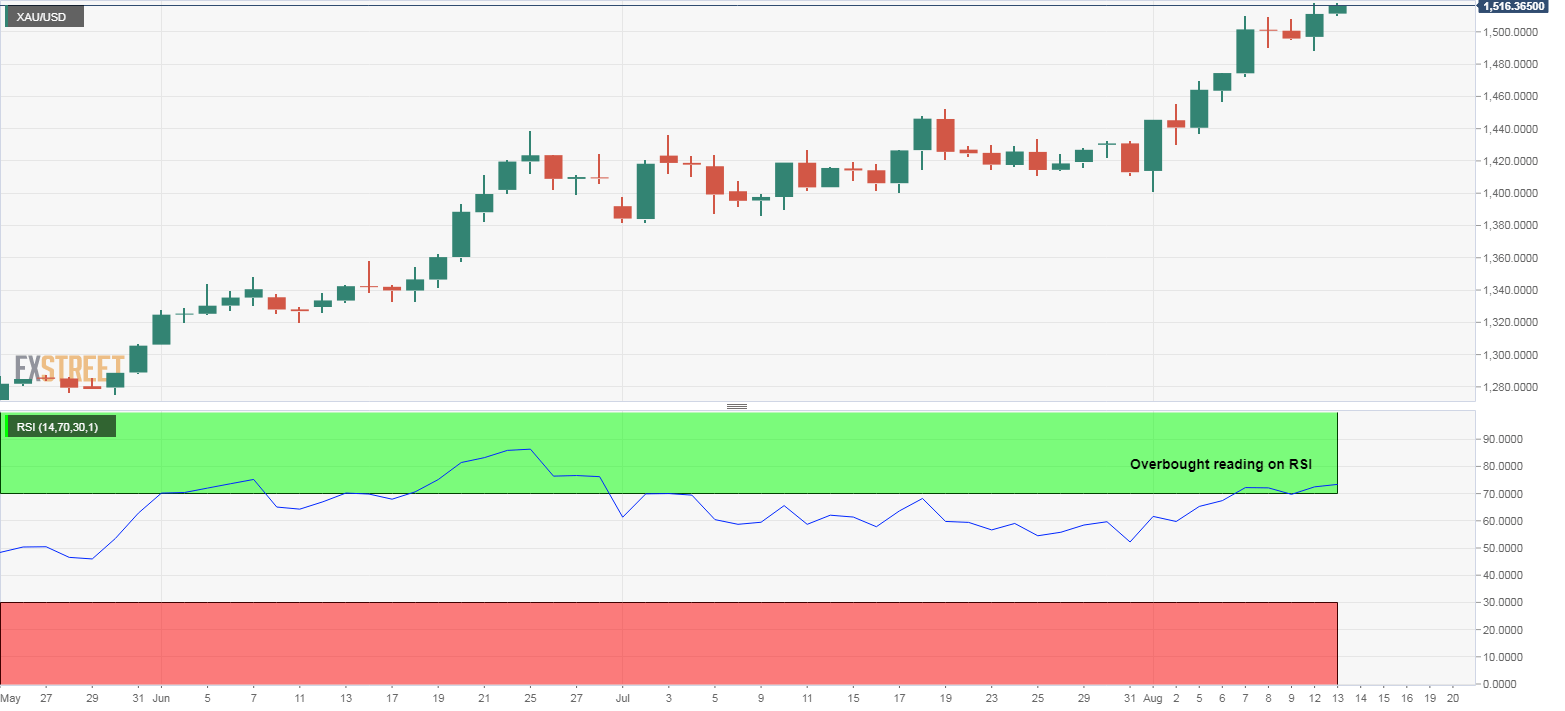

- The daily RSI is reporting overbought conditions. Prices, however, are showing signs of buyer exhaustion.

Gold is just $3 short of setting a fresh six-year high above $1,520.

The yellow metal continues to rise despite technical indicators like the 14-day relative strength index reporting overbought condition with an above-70 print.

It is worth noting that an overbought reading on the RSI does not imply a bearish reversal and is merely a sign the rally is overstretched.

Also, in a strong trending market, the RSI can stay overbought longer than the sellers can stay solvent.

Put simply, the outlook remains bullish and the overbought readings on the RSI would gain credence if and when signs of bullish exhaustion emerge on the daily chart in the form of Doji candle, bearish engulfing, bearish outside day, etc.

Daily chart

Trend: Bullish, overbought

Pivot points