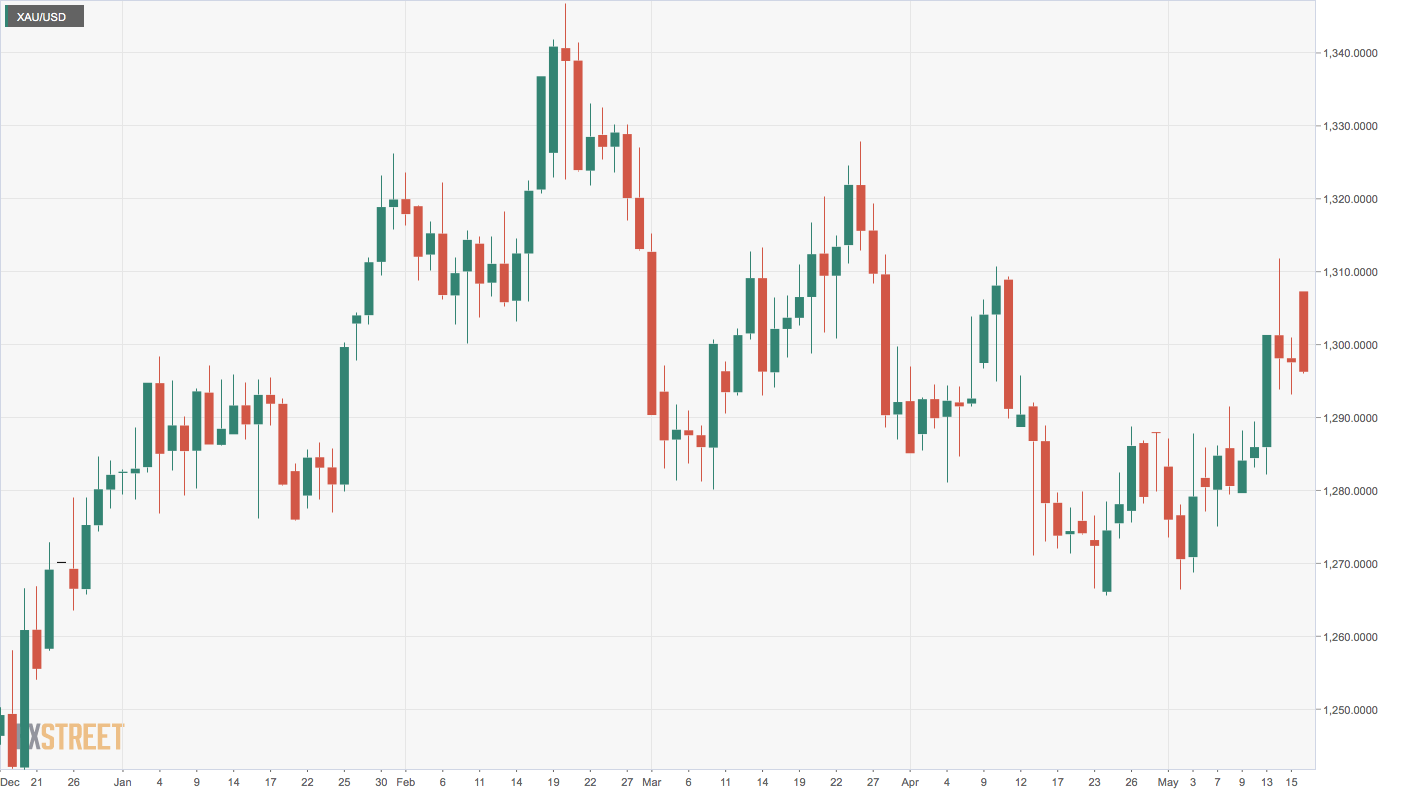

- Gold created a doji candle on Wednesday, taking the shine off Monday bullish breakout.

- Acceptance below Doji’s low could prove costly.

The haven demand for Gold weakened on Wednesday one hopes that the US trade tensions with China and Europe will dissipate.

Markets were first buoyed by President Trump’s comments that talks between Washington and Beijing had not collapsed.

The risk assets received a shot in the arm in the US trading hours after the news hit the wires that Trump is planning to delay a decision on imposing tariffs on cards and parts by up to six months.

The safe haven yellow metal, therefore, created a Doji candle, aborting the bullish view put forward by the descending channel breakout on Monday.

A close today below $1,293 (Wednesday’s low) would validate bullish exhaustion/indecision signaled by the doji candle and open the doors to $1,282-$1,280.

A close above $1,30.90 (Wednesday’s high) would invalidate the doji candle, although a movie above $1,303.40 (Tuesday’s high) is needed to revive the bullish view.

Daily chart

Trend: Bullish above $1,303.4

Pivot points