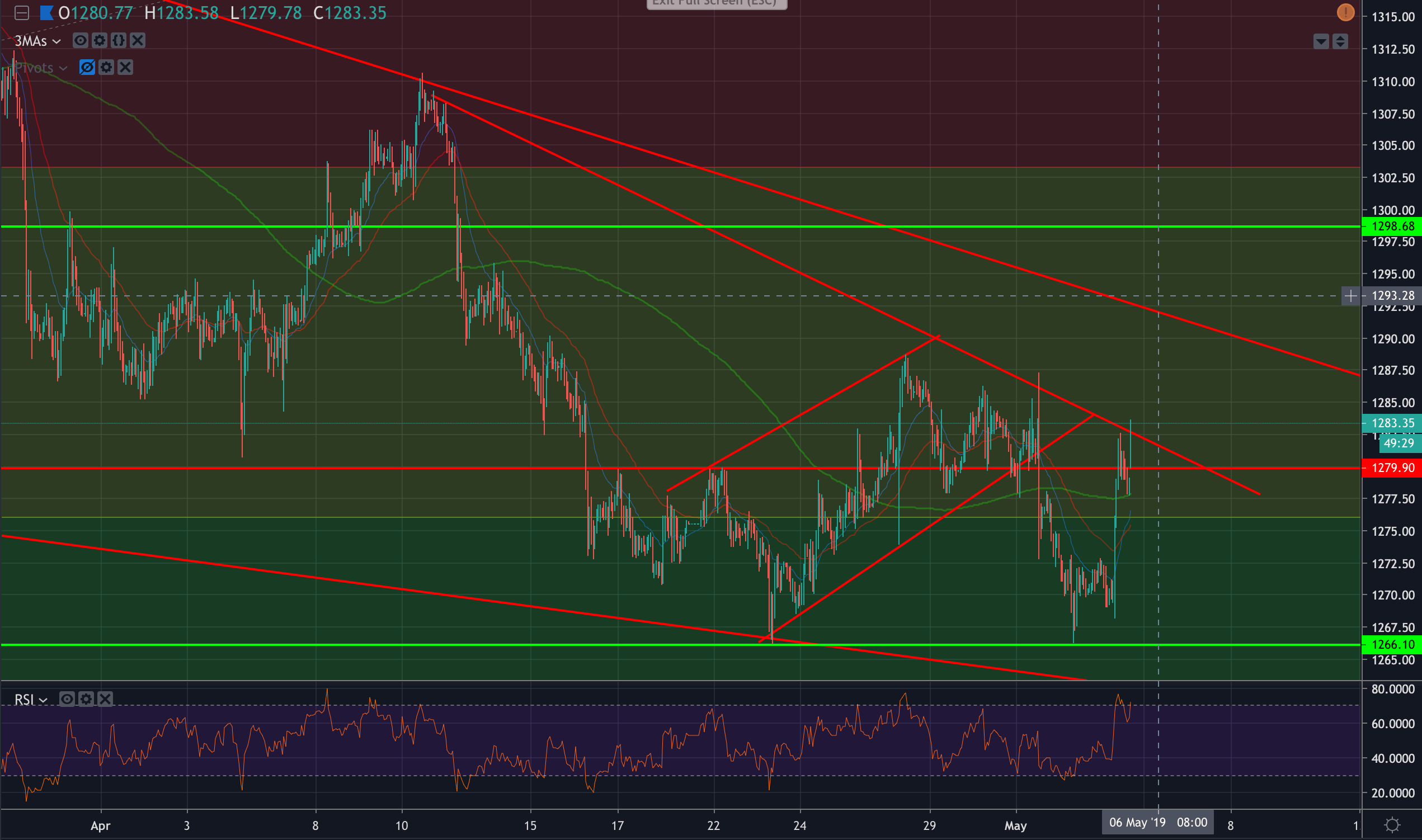

- Gold prices have popped up to resistance on the open in a risk-off start to the week, (Breaking: Trump’s threat to lift tariffs on Chinese imports sends risk assets into reverse, Yen is 0.34% higher vs dollar).

- bulls need to get back and hold and close above 1280/84.50 for a look in at 1298.

- A close above 1298 should negate the bearish bias but a close above R2 at 1302.80 would be ideal.

- On a correction back to the downside would target a run to a confluence area where the 200-DMA meets that 50% Fibo down at 1253.

- A breakdown there opens the 61.8% Fibo target at 1231 which meets the mid-Dec lows/Oct resistance. Meanwhile, the price is held at the 1266 support level.