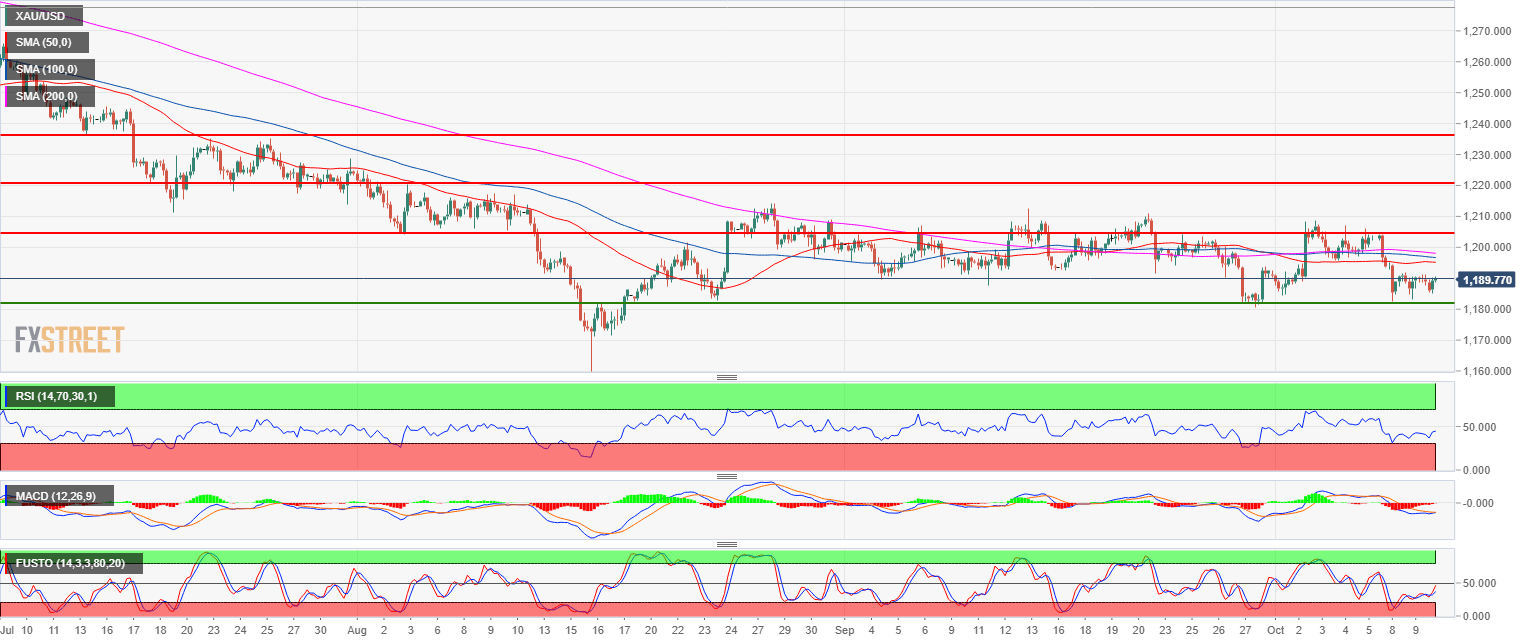

- The Yellow Metal has been trading sideways for nine consecutive weeks.

- Gold is being supported above 1,182.90 support. Gold is keeping the range intact as bulls will try to reach 1,211.17 July 19 low. The RSI, MACD and Stochastic indicators are constructive to the upside.

- However, a bear breakout below 1,182.90 can send gold to 1,172.82 (current 2018 low).

Rate: 1,189.74

Relative change: 0.02%

High: 1,191.41

Low: 1,185.37

Main trend: Bearish

Short-term trend: Bullish

Resistance 1: 1,189.49 September 4 low

Resistance 2: 1,194.30 March 10, 2017 low

Resistance 3: 1,204.10, August 3 swing low (key level)

Resistance 4: 1,211.17 July 19 low

Resistance 5: 1,214.30 August 28 high

Resistance 6: 1,217.89-1,220.90 zone, August 6 high and July 18 low

Resistance 7: 1,225.90 July 17 low

Resistance 8: 1,237.60 July 3 swing low

Support 1: 1,182.90 August 24 low

Support 2: 1,172.82 current 2018 low

Support 3: 1,145.20 March, 1 2017 low