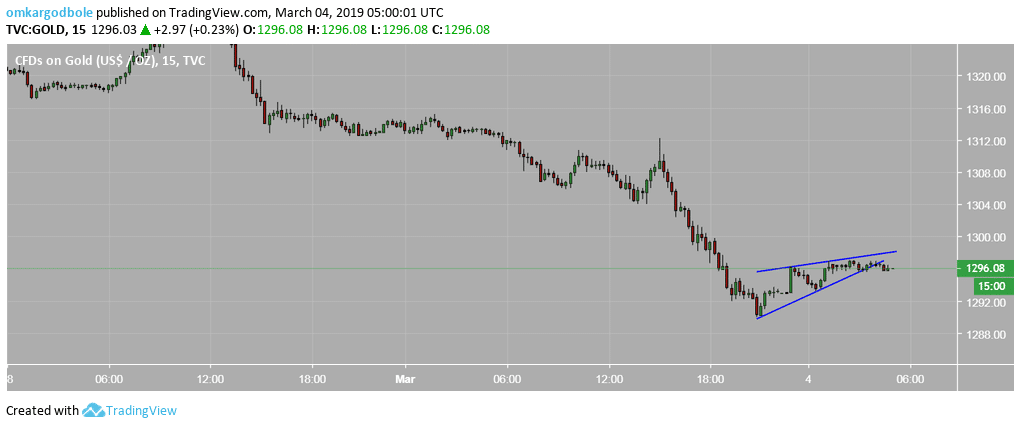

Gold’s corrective bounce from Friday’s low of $1,289 has likely ended and that level could again come into play, the rising wedge breakdown, as seen on the 15-minute chart, indicates.

15-minute chart

The rising wedge breakdown is a bearish continuation pattern, which indicates a revival of the sell-off from Friday’s high of $1,312.

Trend: bearish