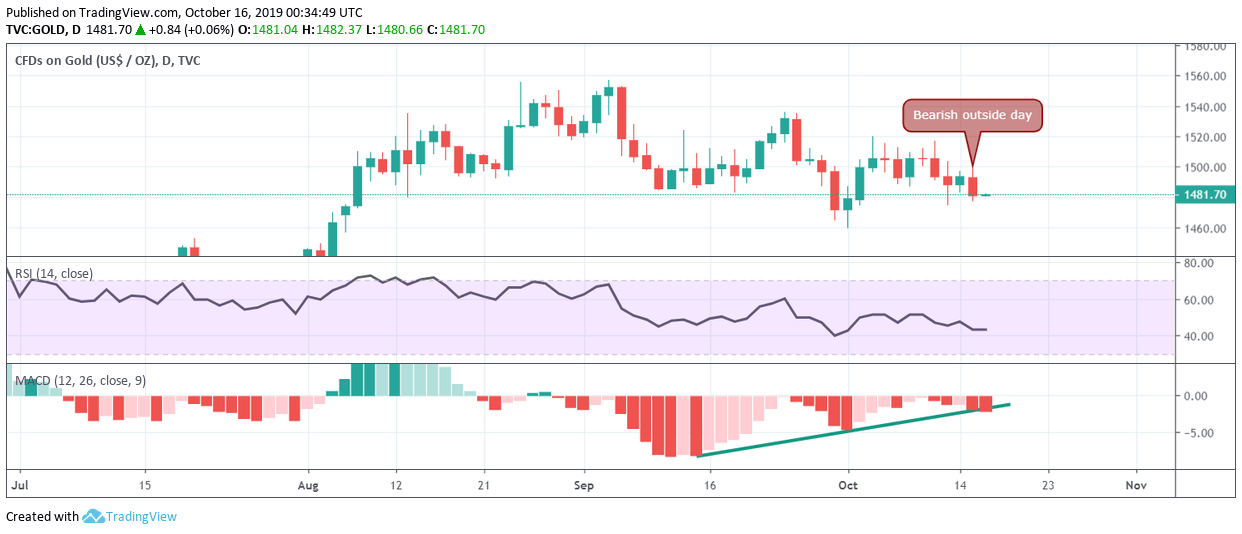

- Gold created a bearish outside day candlestick pattern on Tuesday.

- The daily chart indicators are flashing bearish conditions.

- The yellow metal may face selling pressure and drop to $1,460 in the short term.

Gold risks falling to recent lows near $1,460, having carved out a bearish outside day candlestick pattern on Tuesday.

A bearish outside day occurs when prices end the day on a negative note, engulfing preceding day’s price action. The candlestick indicates impending bearish reversal when it appears after a notable price rise.

In Gold’s case, it indicates the continuation of the pullback from Oct. 10’s high of $1,517.

The bearish candlestick is backed by a below-50 reading on the relative strength index. The MACD has breached the ascending trendline below the zero line – a sign of strengthening bearish momentum.

All-in-all, the path of least resistance appears to be on the downside. On the way lower, key support levels are located at $1,474 (Oct. 11 low) and $1,459 (Oct. 1 low).

The bearish case will be invalidated if the metal closes Wednesday above the bearish outside day’s high of $1,499. As of writing, the yellow metal is trading at $1,482 per Oz.

Daily chart

Trend: Bearish

Technical levels