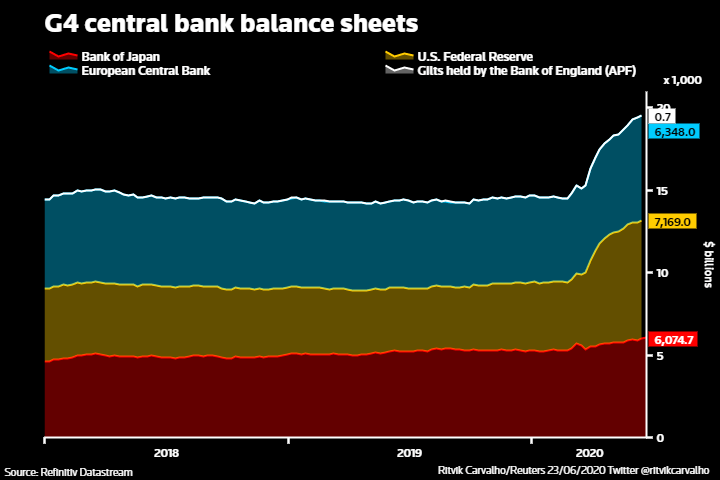

- Gold’s is tracking the G4 balance sheet expansion.

- Gold has gained 12% so far this quarter.

Gold, a hedge against inflation, is currently trading at $1,763 per ounce, representing 12% quarter-to-date gains. Prices rose to an eight-month high of $1,780 on Wednesday.

Some observers are associating the price rally with the estimated $5 trillion in asset purchases unleashed by the G4 central banks – Federal Reserve, European Central Bank, Bank of England, Bank of Japan – over the past three months.

“Gold loves central bank liquidity,” said Jeroen Blokland, Portfolio Manager for the Robeco Multi-Asset funds, Robeco ONE and Robeco Pension Return Portfolio, tweeted on Thursday.

The massive liquidity injections are aimed at containing the economic fallout from the coronavirus outbreak. However, if gold rally is a guide, investors look to be pricing in stagflation – the combination of slow growth with high inflation and unemployment.

Analysts at Goldman Sachs recently raised their 2020 price forecast to $2,000 from $1,800. The investment bank, however, thinks that a sustained rise above $2,000 would require an above-2% inflation in the US and muted policy response.

Technical levels