- After the weakening of the US Dollar, investors sought refuge in gold.

- The trend for the whole month will be bullish.

- The behavior of the next week depends mainly on the performance of the US economy.

The gold weekly analysis is mildly bullish despite a negative start to the week. The precious metal lost some ground on Friday as the USD reversed.

Gold managed to regain ground lost in the previous week to end this week above 1,810. Despite a negative start to the week, macroeconomic events, particularly the United States news, achieved a trend change that even took the price beyond $1,830 to finally settle above $1810 at the end of the week.

–Are you interested to learn more about buying cryptocurrencies? Check our detailed guide-

The increase in the price of gold is due to the investors’ search for refuge after the Dollar weakened.

The Federal Reserve announced that it would leave the benchmark interest rates at 0-0.25% as expected. In addition, the central bank indicated that it will continue to buy $120 billion in securities monthly until substantial progress is achieved in the economy.

In the press conference that followed the decisions, Fed Chairman Jerome Powell declared that inflation will continue for a longer time than expected.

After all the situation generated by the disappointing Fed announcements, the data released on Thursday, far from calming investors, further weakened the US Dollar and fueled the uptrend of the XAU/USD pair.

The published data showed that the country’s GDP grew 2 points lower than expected in the second quarter. It was also known that there were 400,000 applications for unemployment benefits, 20,000 more than expected by analysts. Even when the core Personal Consumption Expenditures (PCE) increased 3.5% instead of the expected 3.7%, this did not elicit any reaction that could change the pair’s an upward trend.

At the end of the week, some comments from the Fed helped the USD recover some ground.

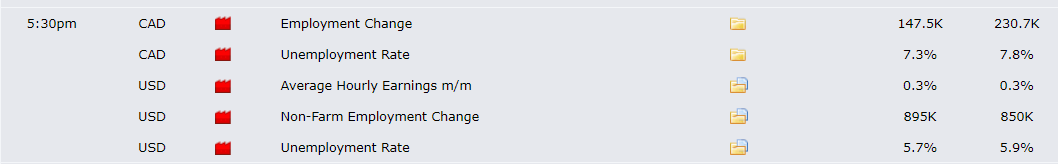

Upcoming events

Due to the US dollar’s recent weakness that made it lose ground in different markets, eyes are still on it, mainly awaiting its unemployment rate and NFP data. However, one should not lose sight of the important events regarding the Euro and the British Pound. Furthermore, Germany will release its retail sales, factory orders, and industrial production data for June next week. Finally, an event of great importance will be the meeting of the Bank of England.

–Are you interested to learn more about forex robots? Check our detailed guide-

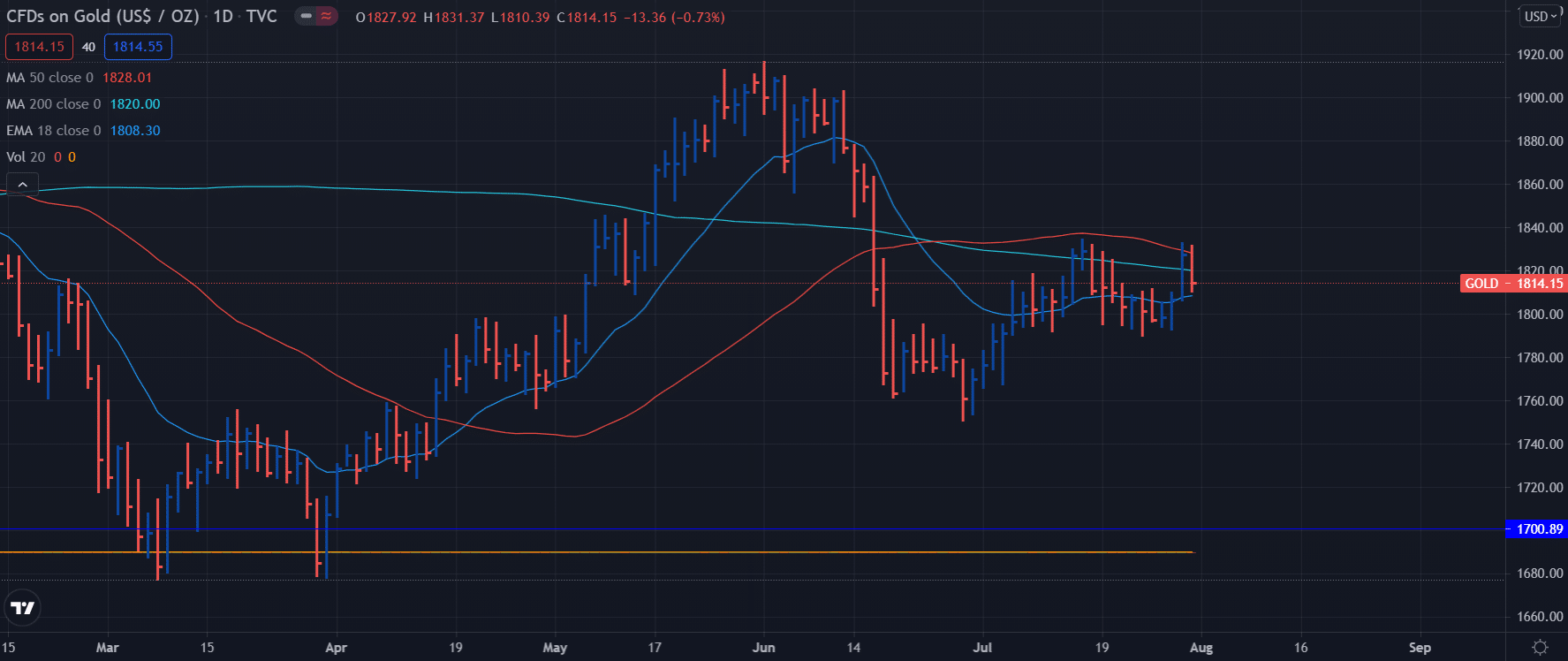

Gold technical analysis: Key levels to watch

The market appears to be moving sideways next week towards the 100-day SMA and 200-day SMA levels. However, this could change depending on the unemployment data in the US. In addition, the bullish momentum may lose its strength following Friday’s pullback.

Initial resistance for the XAU/USD is dictated by the 200 SMA at $1,820, followed by the 50-day SMA at $1,830. On the other hand, the support levels emerge at $1,810, $1,800, and $1,790.

Gold next week forecast

The forecast of gold for the following week is an uptrend in search of the week’s highs at $1,832. In fact, an uptrend is expected for the entire month of August.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.