- The gold price finished in the red for the fourth straight week.

- Since factors supporting the dollar remain unchanged, gold will likely remain in the red.

- Technically, gold is poised to break $1,800.

The weekly gold forecast remains bearish as the Fed’s aggressive rate hikes and risk aversion strongly weigh on the gold price.

After dropping below $1,800 on Friday, the gold price rose on the day on Monday but ended the week down over 3%, posting the second-largest drop in a week of the year. XAU/USD closed below the $1,850 area for two consecutive days, which could be seen as a bearish development that may sideline buyers in the short term.

–Are you interested in learning more about forex robots? Check our detailed guide-

Safe-haven flows bolstered the dollar earlier in the week, causing the XAU/USD pair to drop. According to a report released over the weekend by the International Monetary Fund (IMF), global economic growth may slow faster than expected as inflation rises longer than anticipated. Furthermore, exports from China rose 1.9% in April versus 16.4% expected, beating market expectations.

On Tuesday, the Chinese authorities’ announcement that they would tighten coronavirus restrictions in Shanghai despite a drop in infection rates failed to shift risk attitudes. Meanwhile, several FOMC policymakers have expressed their support for two more rate hikes of 50 basis points (bps) at the next two monetary policy meetings, which would help the dollar remain strong. Additionally, Cleveland Fed President Loretta Mester said they do not rule out permanently raising rates 75 basis points.

In midweek, slightly improved risk sentiment dragged down the greenback, opening the door for an XAU/USD rally. US President Joe Biden said Tuesday that he was considering removing the tariffs imposed by President Trump on Chinese imports to reduce inflation. In addition, as measured by the consumer price index (CPI), the US Bureau of Labor Statistics reported that inflation fell to 8.3% year-over-year in April from 8.5% in March. Gold managed to end the day in positive territory as yields on ten-year US Treasury notes fell below 3% after these data.

The risk rally failed to last, and Thursday’s bad market sentiment caused the safe-haven dollar to surge, causing gold to suffer heavy losses for the first time since February. As a result, the US dollar index reached 104.92, its highest level in almost two decades, as FOMC Chairman Jerome Powell reiterated his expectation of two more rate hikes of 50 basis points in June and July.

Gold traded near a two-month low of $1,810 an ounce in relatively quiet trading on Friday. Although the yellow metal briefly dropped below $1,800 in the US session, it managed to cut some of its daily losses after a monthly report from the University of Michigan showed a decline in US consumer confidence in early May.

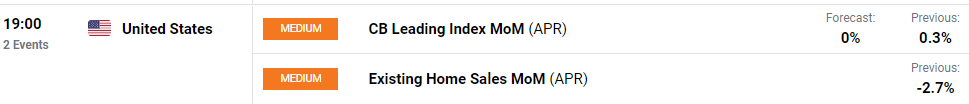

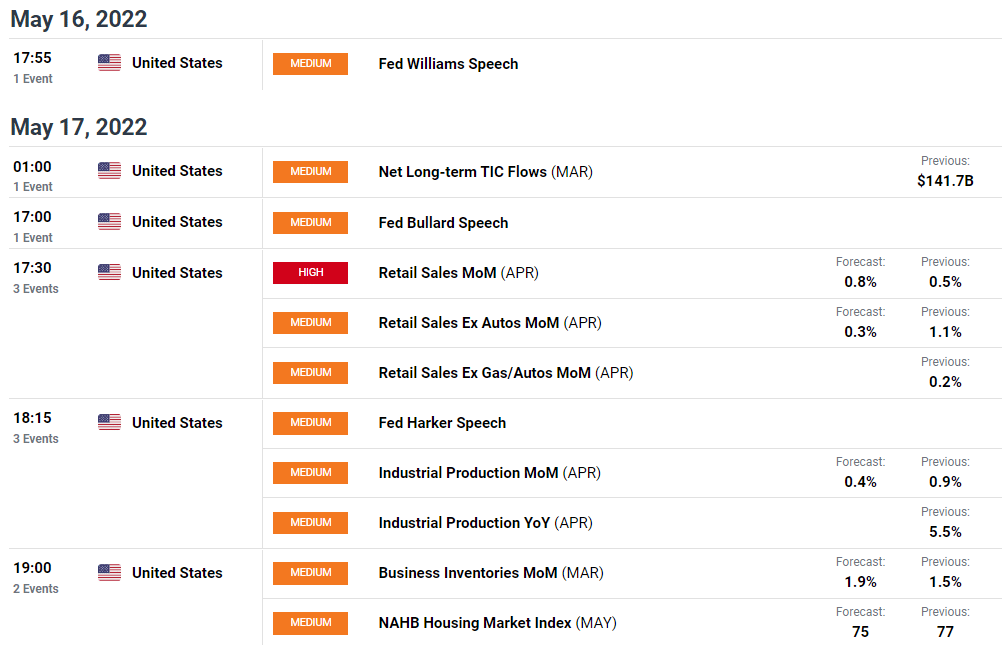

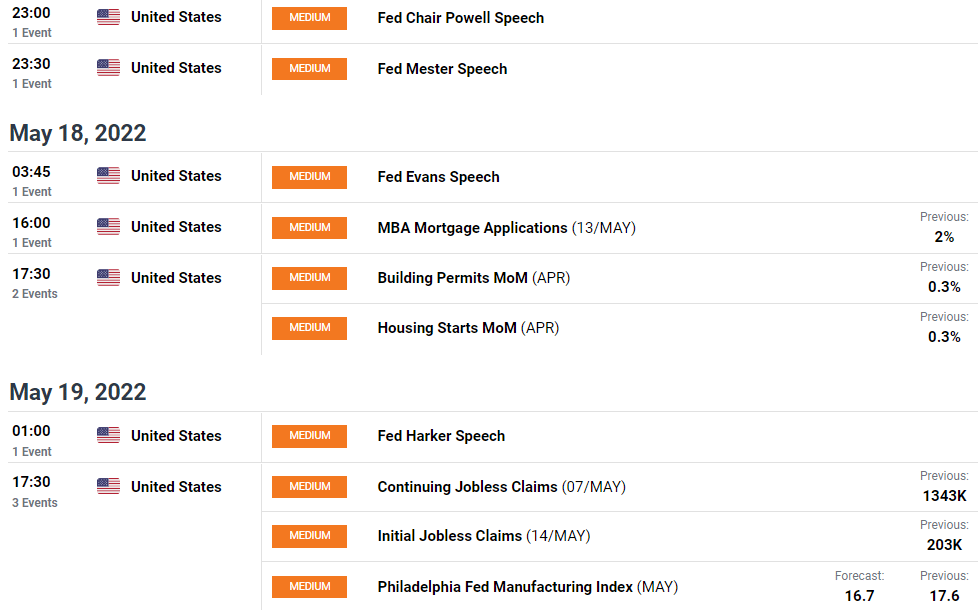

Gold data/events next week

Retail sales in China, which are expected to fall 6% year-on-year in April, will be closely watched by investors starting early Monday. When data from China reminded investors that the lockdown was negatively impacting economic activity, gold has struggled to find demand. If sales drop sharper than expected, we may see a similar reaction early in the week. Positive readings may limit gold losses, but they are unlikely to trigger a risk rally unless Chinese authorities ease restrictions in Shanghai and Beijing.

According to the US Census Bureau, retail sales in the US increased by 0.6% month-over-month in April. Again, it would be unexpected to observe a significant shift in risk attitudes in a single data point. Even if a bullish push helps US equities gain momentum, it will also reinforce the Fed’s view that it can continue raising interest rates aggressively without worrying about hurting the economy. Furthermore, healthy consumer demand can be considered a factor that could fuel inflation.

The Philadelphia Federal Reserve will release its weekly initial jobless claims report later this week.

It seems unlikely that the dollar will weaken at this point in time. However, due to China’s restrictions and the tightening of Fed forecasts, the ongoing Russian-Ukrainian conflict should influence the dollar’s value next week. Therefore, it can be expected that attempts to recover gold will be limited in the near future.

–Are you interested in learning more about South African forex brokers? Check our detailed guide-

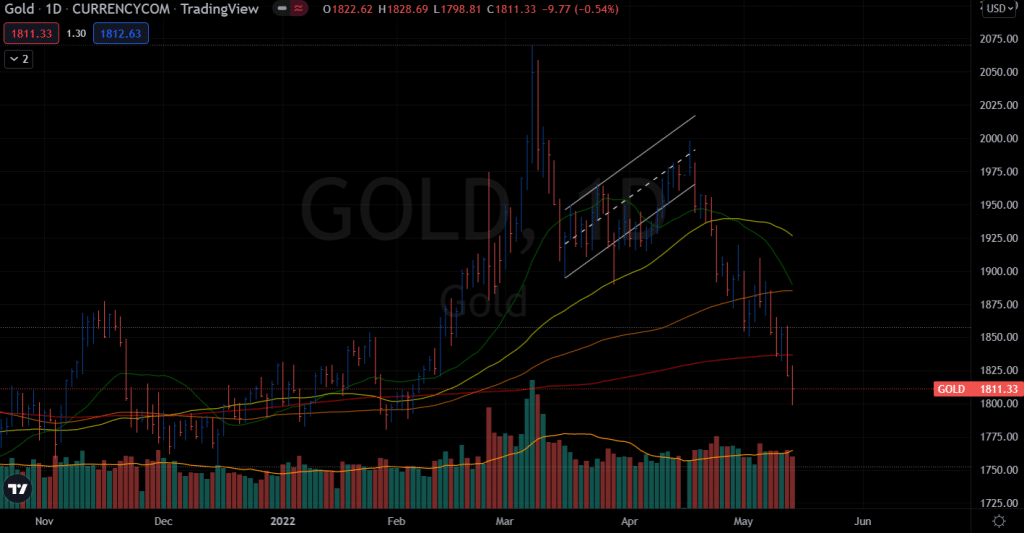

Gold weekly technical analysis: Bears to break $1,800

The daily chart shows a strong bearish forecast for the week as the price broke below the 200-day SMA. The metal also briefly broke the $1,800 mark but managed to close above it. However, the next support in view is $1,785 ahead of $1,750. The upside potential remains capped by $1,830-50 area.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money