- Weekly gold prices rose to their highest levels since mid-November.

- XAU/USD strengthened following a sharp drop in US Treasury yields.

- As high-level US data and the Fed policy meeting are released, attention turns to them.

The gold price weekly forecast is mildly positive as the metal hit multi-week highs when the US Treasuries slipped putting gold on top as a safe-haven asset.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Despite a weak start to the week, gold rallied strongly on Wednesday, breaking through a key resistance area to hit a nearly two-month high on Thursday at nearly $1,850. The yellow metal then went into consolidation mode, giving back part of its weekly gain but ending in positive territory for the second consecutive week.

During the first half of the week, the US Treasury yields were supported by rumors that the US Federal Reserve could hike interest rates by 50 basis points in March. Early Wednesday, the benchmark 10-year Treasury yield hit a two-year high of 1.9%.

As the second half of the week progressed, safe-haven flows began to dominate the financial markets, and a sharp decline in US Treasury yields fueled the gold rally.

Investors have sought safe-haven assets due to a deteriorating economic outlook, the ongoing conflict between Russia and Ukraine, and attempts by the People’s Bank of China to ease policy. In addition, the US Department of Labor reported on Thursday that 286,000 initial jobless claims were filed in the US last week, the highest since October, further dampening sentiment.

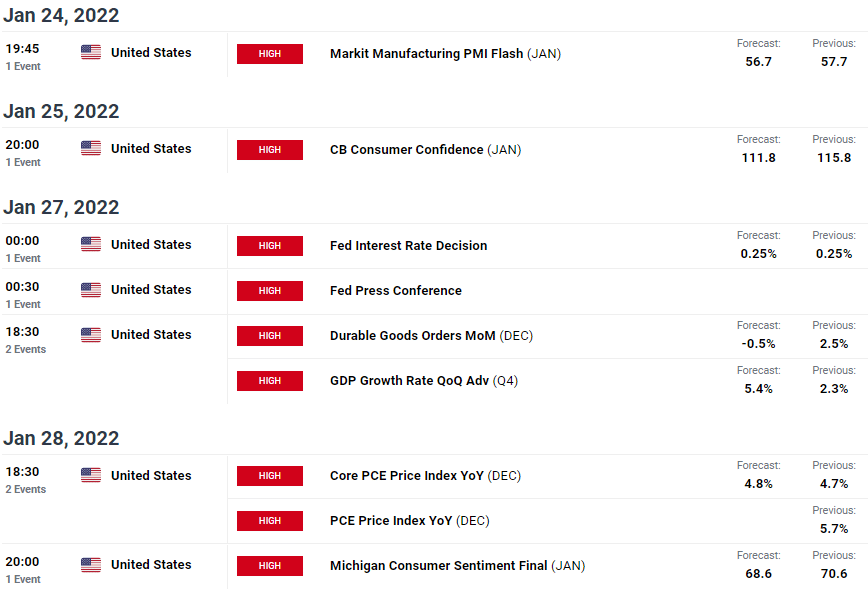

Key data/events for gold next week

The US Bureau of Economic Analysis will release its first estimate of fourth-quarter gross domestic product (GDP) growth next week. According to economists, the GDP will increase to 5.8% in the fourth quarter from 2.3% in the third quarter. If economic activity rises, the dollar should remain strong, but the currency could lose value even if the Federal Reserve refrains from using dovish language if the reverse is true.

Additionally, the December Conference Board consumer confidence index and the IHS Markit preliminary manufacturing and services PMI for January were released. The market, however, is unlikely to react to these data and is likely to wait for the Fed’s policy statement.

–Are you interested to learn more about ETF brokers? Check our detailed guide-

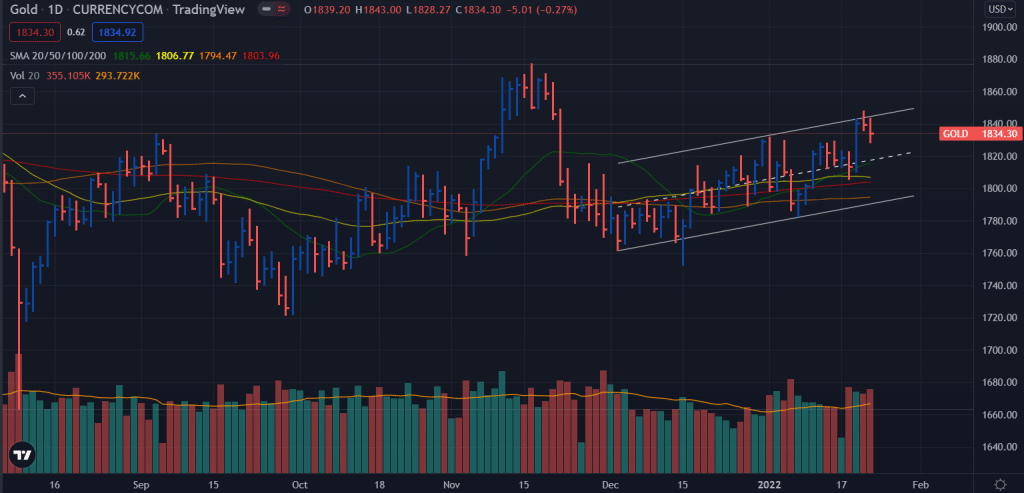

Gold weekly technical analysis: Ascending channel arrests price movement

The gold price rose to $1,848 but found rejection at the upper band of ascending trend channel. The congestion zone of key SMAs at $1,795 – 1,813 may attract the price. Meanwhile, the ascending channel also forms a potential bearish flag pattern that may result in a breakout any time next week or later. So, we have to wait and watch for the breakout of the channel zone on either side to find high probability trading opportunities.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.