- Perpetual’s funding rates show how assets can be sold at the top or bought during dips.

- A flat funding rate of 0.01% or negative is precisely a buy the dip.

- A funding rate of 0.1% or more implies that the asset is in euphoria, and it is time to take profit.

Bull markets are exciting periods in the lives of investors and traders. However, knowing how to take advantage of the downswings gives some investors an edge above the others. It is worth keeping in mind that there is hardly a bull market without corrections. For instance, Bitcoin dipped from $35,000 to $28,000 before rallying to $42,000 in early January.

Funding rates offer insights on selling the top and buying the dip

Speculation often hits the roof in bull markets, and it can easily lead to the fear of missing out (FOMO). As a trader or investor, it is prudent to avoid buying the top in FOMO while being precise when buying the dip.

How to buy the dip

An asset’s perpetual funding rate can either be positive or negative. Realize that when this funding rate is flat to negative (negative is desirable) and the asset’s perpetual-spot basis is negative, it is advisable to buy. According to Alex Krüger, a renowned trader and analyst, the trick is to stagger the orders if in doubt. Nonetheless, making sure not to sell dip but by the dip is a crucial decision.

How to sell the euphoria

To precisely time the euphoria, look for an asset’s funding rate of 0.1% or more every eight hours. This signifies the presence of euphoria and can easily be identified on the funding or the futures curve.

At the euphoria level, investors or traders can begin to cash out partial profits. If one is not ready to take out the gains, it is best not to get into open positions. The Holy Grail is not buying the FOMO as it usually costs you money in the long run. More importantly, fundamental technical indicators such as the moving averages and the Fibonacci levels will help better euphoria and the dip timing.

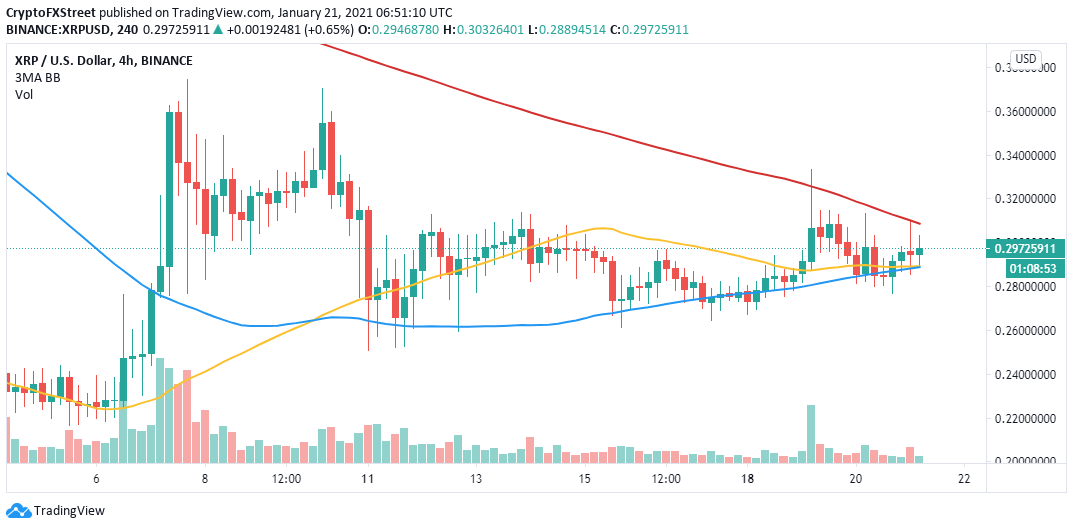

According to ViewBase, Ripple (XRP) has nearly a flat rate of 0.1% on Binance exchange. It implies that the cross-border token is in a buy zone. However, the 4-hour chart shows that XRP is stuck in consolidation between the confluence support (formed by the 50 Simple Moving Average and the 100 SMA) and the 200 SMA.

XRP/USD 4-hour chart

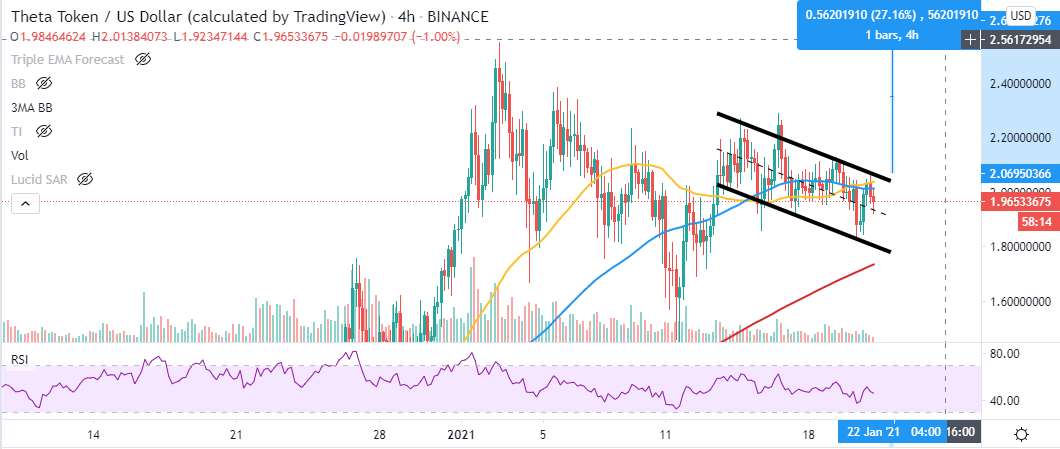

THETA is one of the cryptoassets with a desirable buy the dip funding of -0.0395. This shows that THETA is an excellent asset to buy the dip. The short-term technical outlook seems to validate the call to buy with a bull flag on the 4-hour chart. A break above the pattern could culminate in a 27.5% spike to $2.5.

THETA/USD 4-hour chart

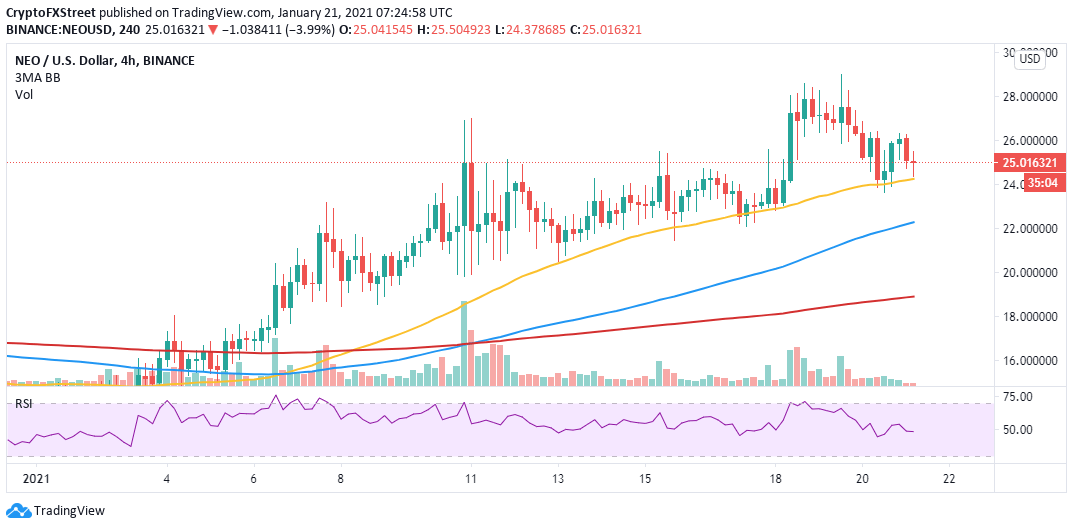

Similarly, NEO has a negative funding rate of -0.027 on FTX and a flat rate of 0.01 on Binance. Its technical picture looks bullish after support at the 50 SMA held ground. Closing the day above the short term hurdle at $26 would add credibility to the bullish leg toward $30.

NEO/USD 4-hour chart

FOMO in the bull market fuels speculation, leading to inadequate risk management. Using funding rate buy the dip and sell the top technique traders and investors would property enter positons and exit the others at the right time.