I hope you had some great time during the holiday break, but unfortunately it always ends too fast, but we are lucky that we love our job, right?

Before we head to the charts, let’s see what could happen on this market based on sentiment and psychology. Well, if you remember, I highlighted on Thursday that the holidays are approaching which is usually the reason for a change in trend because of portfolio adjustments and so on. At that time, we were expecting higher EURUSD, which was clearly the case in the last few trading days.

The same was expected on S&P futures which also changed direction a few sessions back. Well, we need to keep in mind that in normal trading days, money will flow back into the market, so what this means is that the primary trend, which was down on EUR and up on stocks could resume. With that in mind, be aware of continuation of a trend that was ahead of holidays.

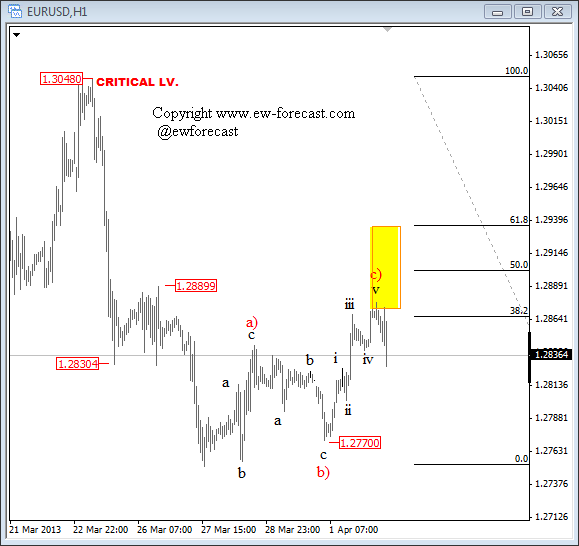

In fact, from a technical perspective we can see only a three wave rise on EURUSD from the lows which is corrective movement that also reversed down from swings of wave four of a lesser degree. The pattern is bearish on the EURUSD which could fall beneath 1.2750 in this week. Resistance is at 1.2870-1.2940.

EURUSD 1h

For now, I like the pattern on EURUSD and even USDCHF and we could be looking for USD longs if we see evidence of an impulsive price action in the direction of a stronger dollar.

Trade well,

Grega

Visit our website and Get more charts and forecasts with free access through 7-Day Trial Offer.

You can also follow us on twitter @ewforecast