After we’ve seen some EUR/USD strength on the background of the Chinese devaluation, we could see a move in the other direction.

The team at BNP Paribas explains:

Here is their view, courtesy of eFXnews:

In a note to clients today, BNP Paribas discusses the G10 FX impact of CNY devaluation.

1- “As the CNY tends to anchor Asian FX moves, it is natural that the weaker CNY is associated with further weakness among Asian currencies,” BNPP argues.

2- “This trend should extend to G10 currencies in the region especially AUD, NZD and JPY. The JPY is most likely to attract official intervention to limit weakness. Australia and New Zealand will likely welcome further currency weakness given rhetoric from monetary authorities,” BNPP projects.

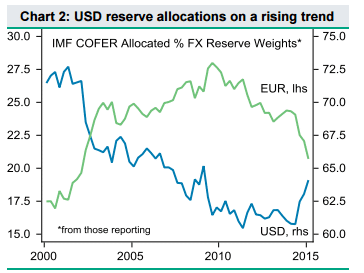

3- “Asian central banks are likely to intervene to slow currency depreciation rather than reversing it. As USD reserves are depleted, buying USDs vs G10 currencies will be required to prevent USD allocations falling. Reserve managers have pushed average USD allocations to around 64% and will likely chose to maintain that trend,” BNPP adds.

4- “The associated portfolio rebalancing would require EURUSD selling,” BNPP argues.

5- “Partially offsetting some of the USD-bullish trend may be reduced FOMC tightening expectations. This trend may moderate rather than drive the USD trend,” BNPP adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.