USD/INR technical analysis: Indian Rupee may begin the week on a positive note

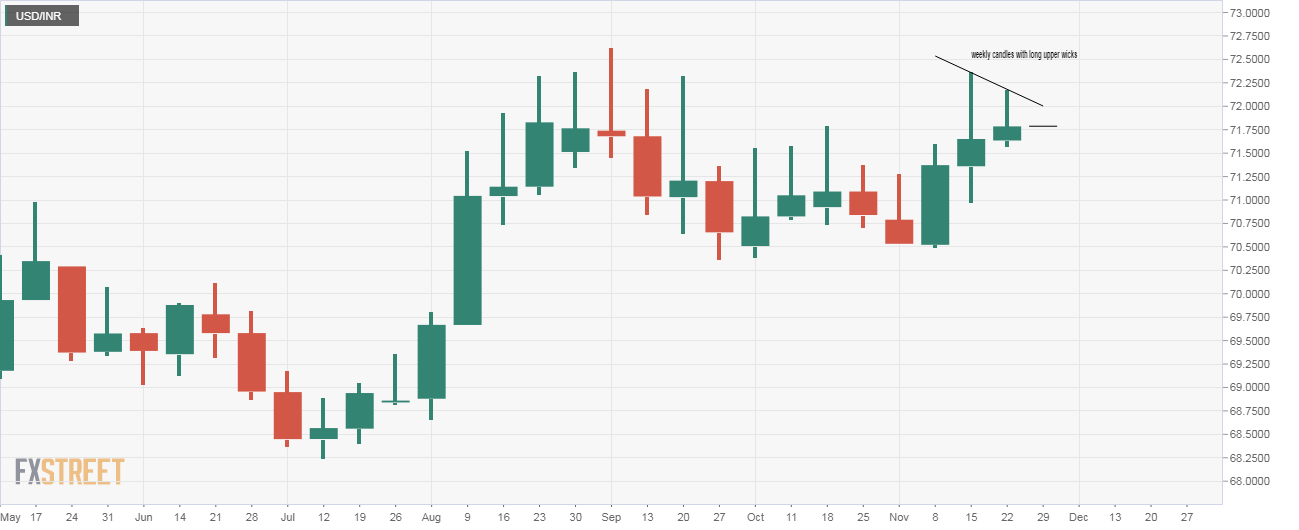

The Indian Rupee will likely post gains on the first trading day of the week, as USD/INR’s bounce from 70.55 seems to have run out of steam.

The back-to-back weekly candles with long upper shadows are indicating buyer exhaustion. The shallow bars on the MACD histogram are also echoing similar sentiments. Read more”¦

USD/INR fails to recover beyond the 10-day SMA amid cautious optimism in Asia

Following its failure to provide a daily closing beyond 10-day SMA, USD/INR drops to 71.66 while heading into the European open on Monday.

The price seems to have been witnessing downside pressure from the cautious optimism surrounding the Asian markets. The reason could be positive comments from the US President Donald Trump and pro-Democracy candidates leading in Hong Kong’s early election results.

Also, China’s recently announced penalties for intellectual property (IP) theft has been triggering hopes for US-Sino commerce agreement. Read more…