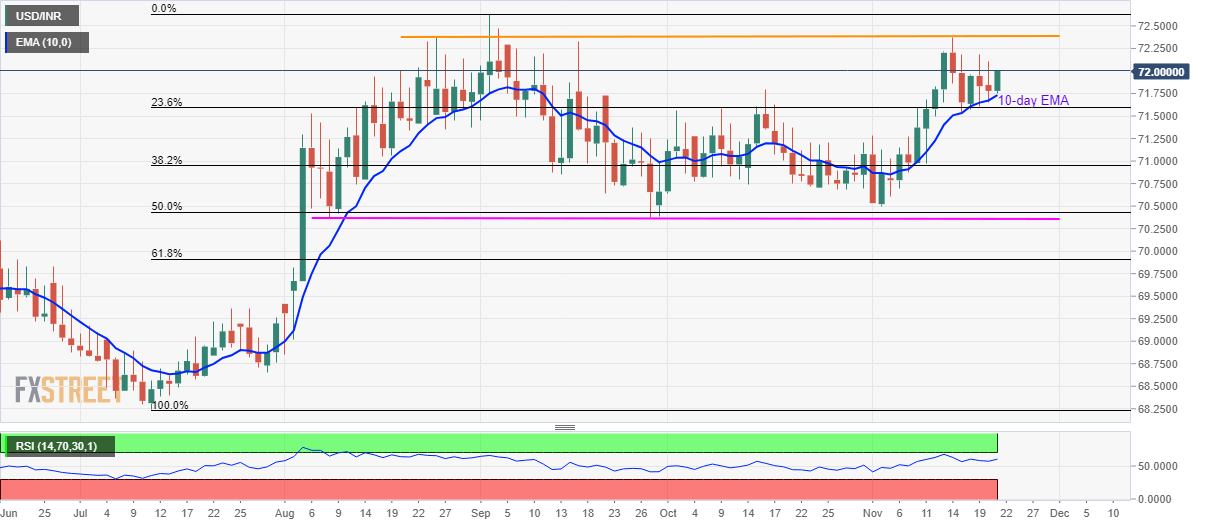

USD/INR Technical Analysis: 10-day EMA keep driving buyers to 72.37/38 supply zone

Yet another U-turn from the 10-day EMA, USD/INR takes the bids to 72.00 during Thursday’s Asian session.

The recovery is also supported by bullish conditions of the 14-day Relative Strength Index (RSI), which in turn favors further upside for the price.

In doing so, highs marked during late-August and mid-November, around 72.37/38 will be the key to watch as a break of which could escalate the currency pair’s run-up to the yearly top close to 72.65 while highlighting December 2018 peak of 72.82 afterward. Read more”¦

USD/INR: Mildly positive as US-China row confronts Indian government measures

With mixed sentiment surrounding the US-China deal keeping the USD on the front-foot, USD/INR finds it hard to extend gains following the Indian government measures. Dollar/rupee stays mildly bid while taking rounds to 71.82 ahead of the European session on Thursday.

On Wednesday, the Indian cabinet announced steps to divest five Public Sector Undertakings (PSUs) while announcing additional measures, such as a two-year moratorium for telecom companies. Moreover, the Securities and Exchange Board of India (SEBI) released notifications that could positively affect market investments and solve trading problems. Read more…