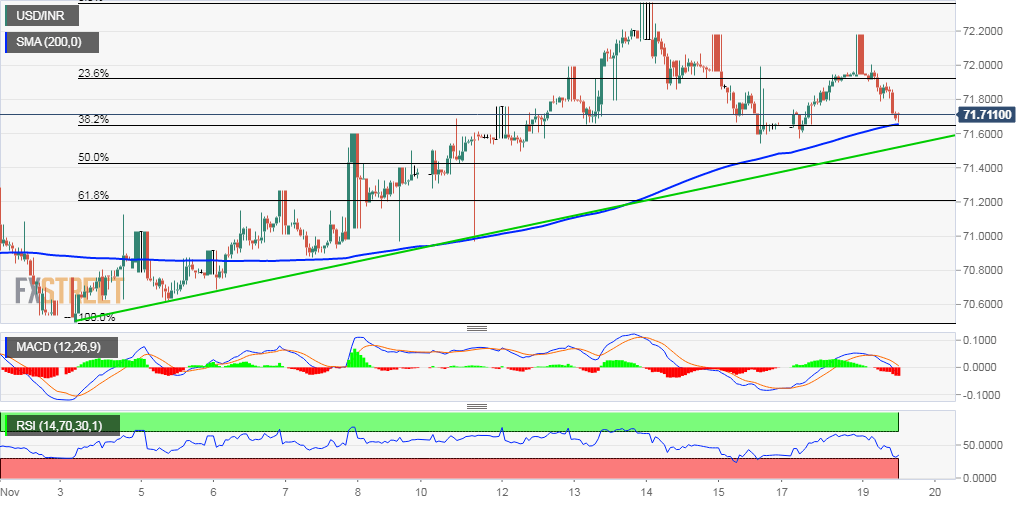

USD/INR: Bears hit 38.2% Fibo./200-hour SMA confluence

After an initial uptick to levels beyond the 72.00 handle, the USD/INR pair came under some renewed selling pressure and has now eroded a major part of the previous session’s gains.

The downtick, also marking the third day of a negative move in the previous four, dragged the pair back closer to a support line marked by 38.2% Fibonacci level of the 70.53-72.37 move up. Read more”¦

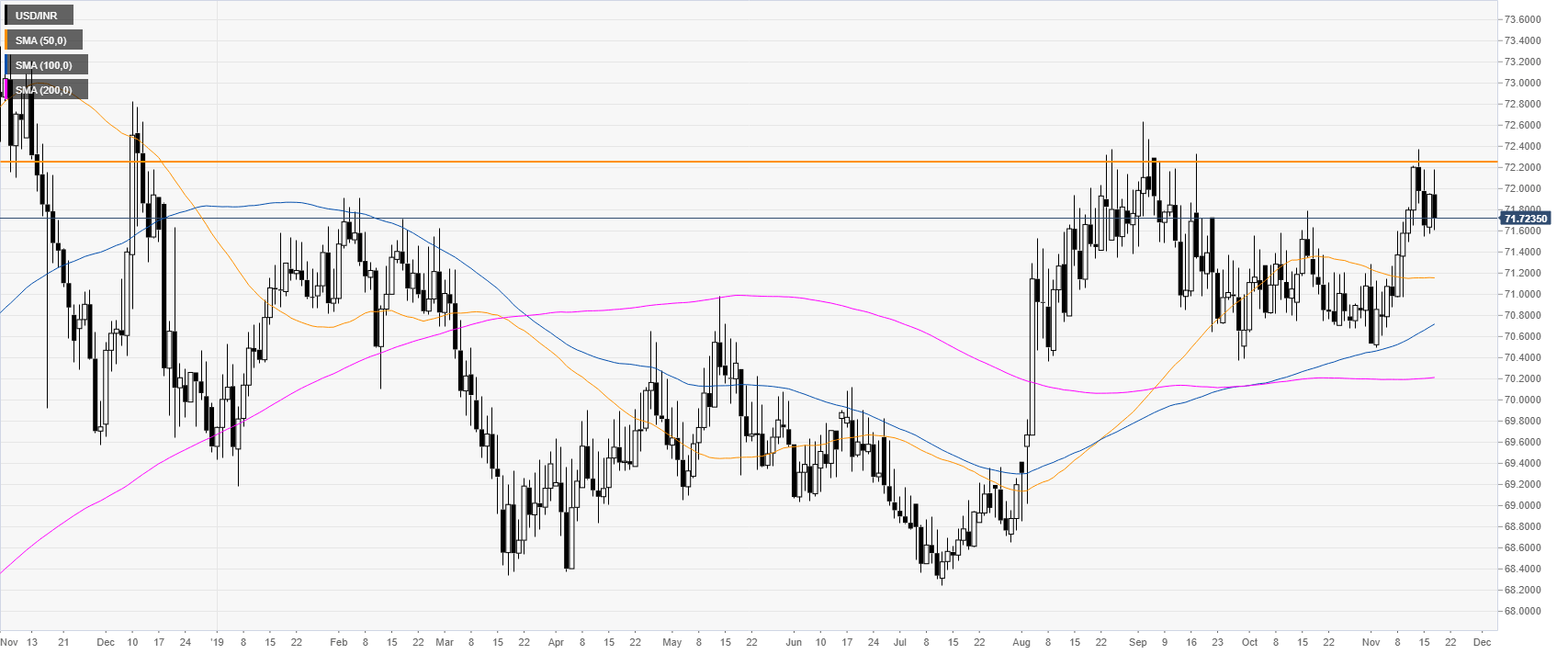

Dollar trading below 72.00 against Indian rupee

Markets are challenging 71.60 support and the 50 SMA. If the market bounces from here, the spot can revisit the 72.00 handle and possibly the 72.25 resistance if the bulls gather enough steam.

On the flip side, a break below 71.60 can see the market decline and trade towards the 71.20 level. Read more”¦