- IOTA has a bearish bias in the short-term.

- An intraday high has been formed at $0.2988 just above the channel resistance.

- The trends of the RSI show the buyers gaining traction against the bulls.

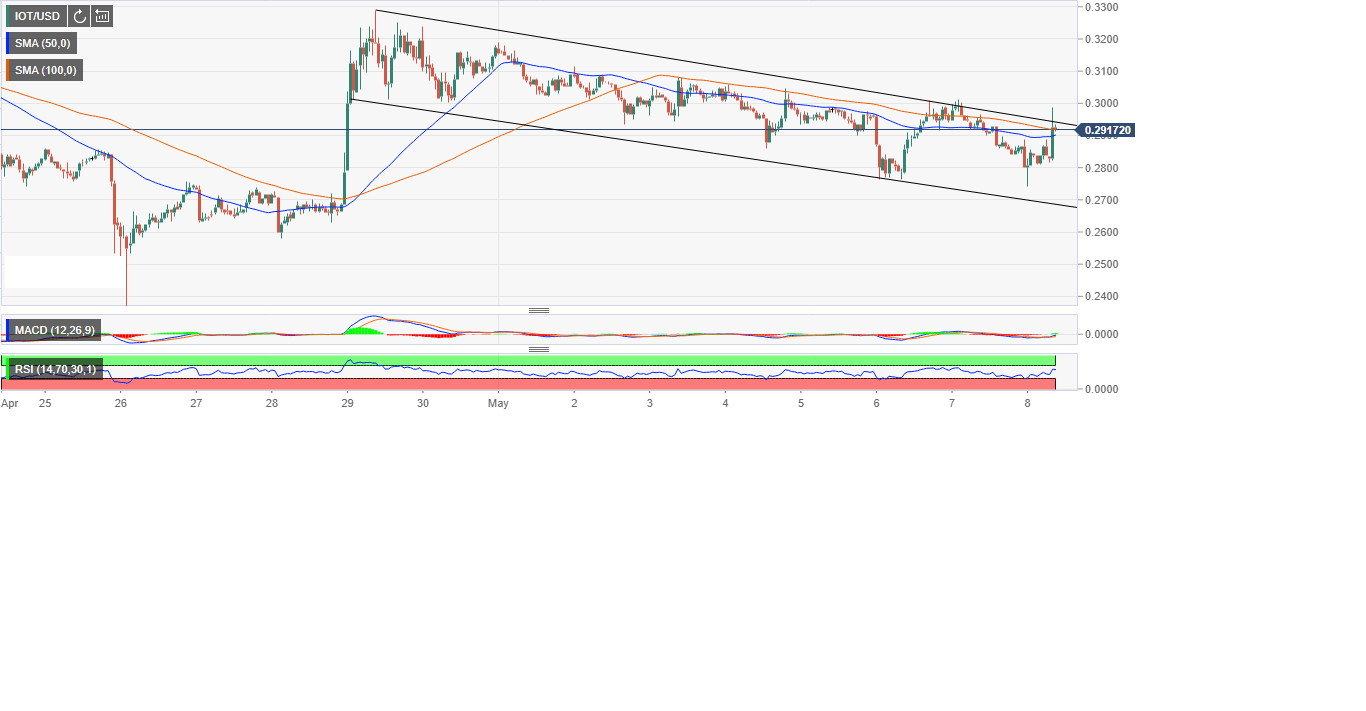

IOTA is currently battling the descending channel resistance that has been capping its upside since April 29 when the surge failed to correct past $0.3293. The price has in the past one week been confined within the falling channel trading lower highs and lower lows. Generally, IOTA has a bearish bias in the short-term unless we can see a formidable rise above the channel resistance.

Recently, IOTA dived to the main support at $0.25 before giving way for an upward move towards $0.3300. A high was formed around $0.3293 resulting in declines. The 100 Simple Moving Average (SMA) has been a critical barrier to the upside with breakouts above it not able to sustain the gains.

Meanwhile, the drop from yesterday’s highs around $0.3000 found support at $0.2800. A correction from the support has pushed the price past both the 50 SMA hurdle and the 100 SMA hurdle. An intraday high has been formed at $0.2988 just above the channel resistance but the price has retreated into the channel to trade at $0.2929 at press time.

The trends of the Relative Strength Index (RSI) shows the buyers gaining traction against the bulls. The slight dips of the indicator inside the oversold has not been able to make significant movements. The RSI has since recovered to 61.76 and still pointing north. The same upward trend is seen in the MACD which is almost breaking into the positive region.

IOT/USD 1-hour chart