The DXY Dollar Index price has found temporary support and is now struggling to gain. Unfortunately, the pressure is still high, so we’ll have to wait for the US data to bring us a clear direction. The current week could be decisive for the US Dollar.

Some poor US economic figures could force the DXY to resume its correction, while better than expected data may help the index return higher. Technically, it moves sideways in the medium to the long term, on the Daily chart.

The ADP Non-Farm Employment Change was reported at 330K versus 695K expected compared to 692K in June. This is bad for the US Dollar. The ISM Services PMI could jump to 60.5 from 60.1 points, while the Final Services is expected to remain steady at 59.8 points.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

Tomorrow, the Unemployment Claims could bring more action on the DXY. Furthermore, the NFP, Average Hourly Earnings, and the Unemployment Rate indicators will be released on Friday. Finally, after worse than expected ADP Non-Farm Employment Change, the Non-Farm Employment Change could come below the 870K estimate, ruining the USD.

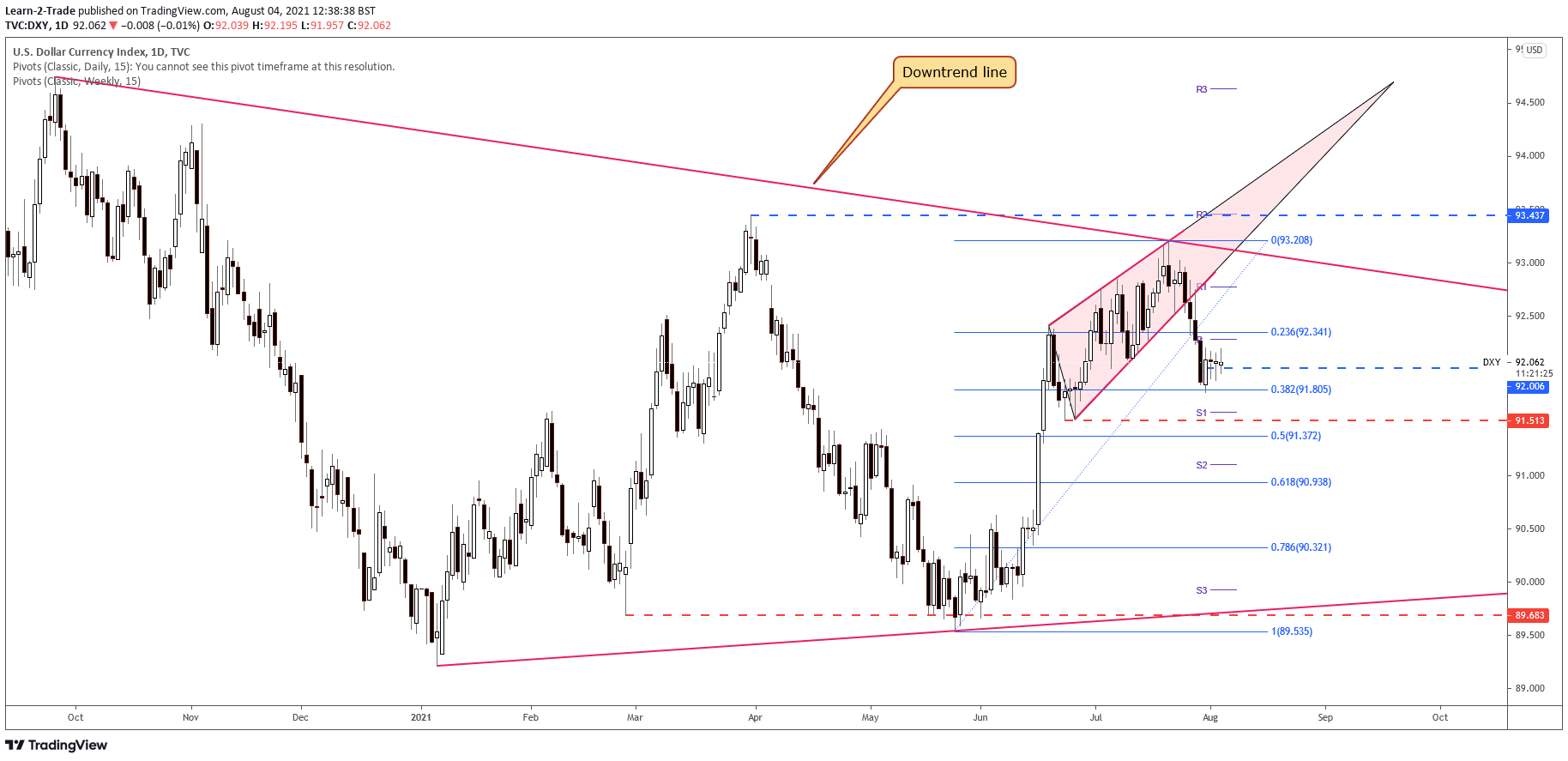

DXY price technical analysis: More down on cards

The Dollar Index has found demand on the 38.2% retracement level, but the pressure is still high as the price failed to come back towards the 23.6% level. Coming back below the 92.00 psychological level and making a new lower low may signal a deeper decline.

If the index resumes its drop after today’s data, the 91.51 lower low is seen as a potential downside target.

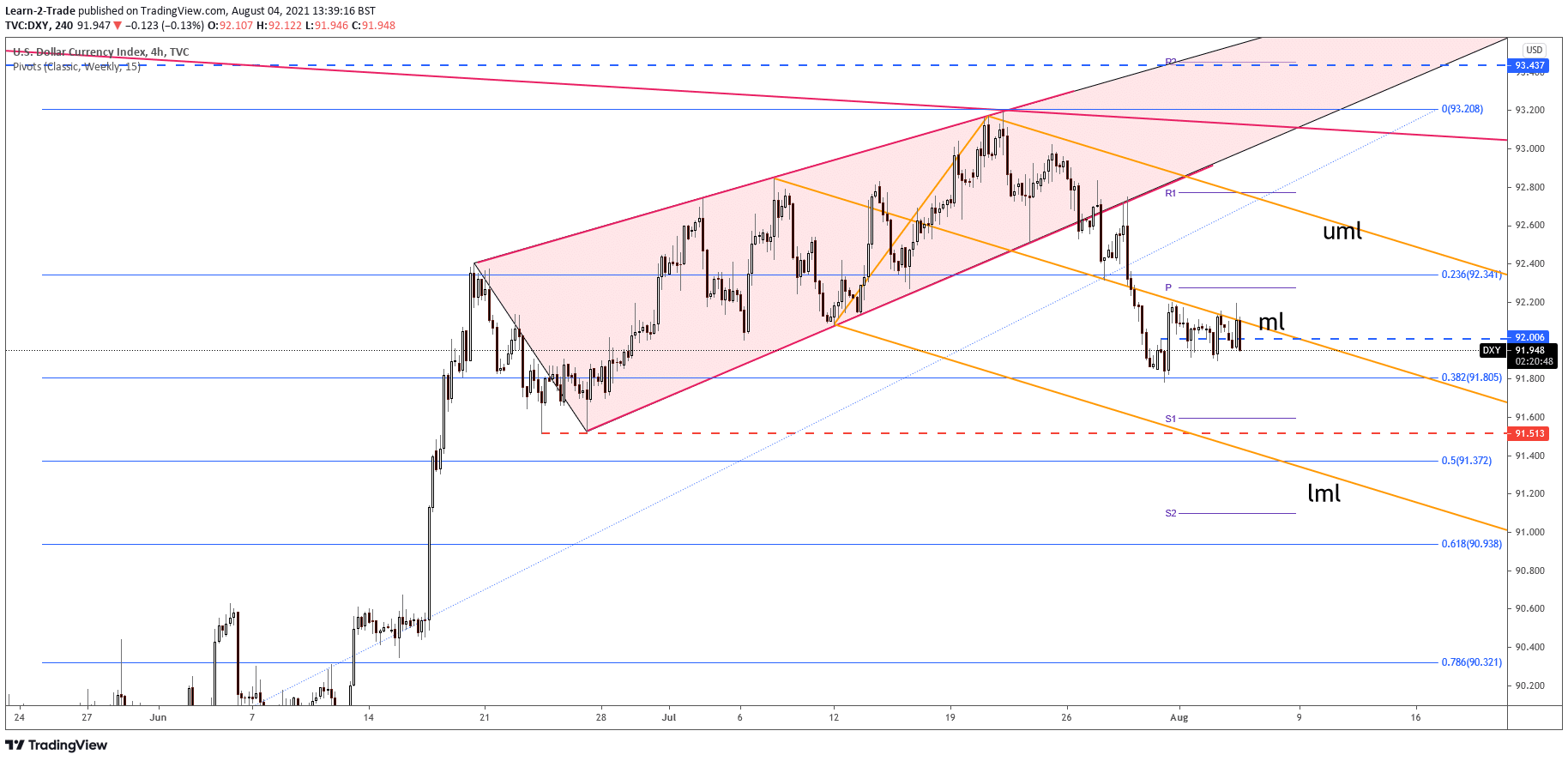

As you can see on the H4 chart, the DXY has registered only false breakouts above the descending pitchfork’s median line (ml). Now is trading in the red, and it could move towards the 38.2% retracement level again.

–Are you interested to learn more about forex signals? Check our detailed guide-

A valid breakdown through this downside obstacle may signal further decline with potential downside targets at 91.51 and down to the descending pitchfork’s lower median line (LML). It could resume its drop as long as it stays under the median line (ML). The further decline signals USD’s depreciation versus its rivals.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.