Analysts at Nomura explained that the Italian budget deadline is approaching and tomorrow the Italian government will update its Economy and Finance report. The document – including the latest government macroeconomic projections for the next three years – will be keenly watched as it will also contain fiscal deficit projections for 2019-21.

Key Quotes:

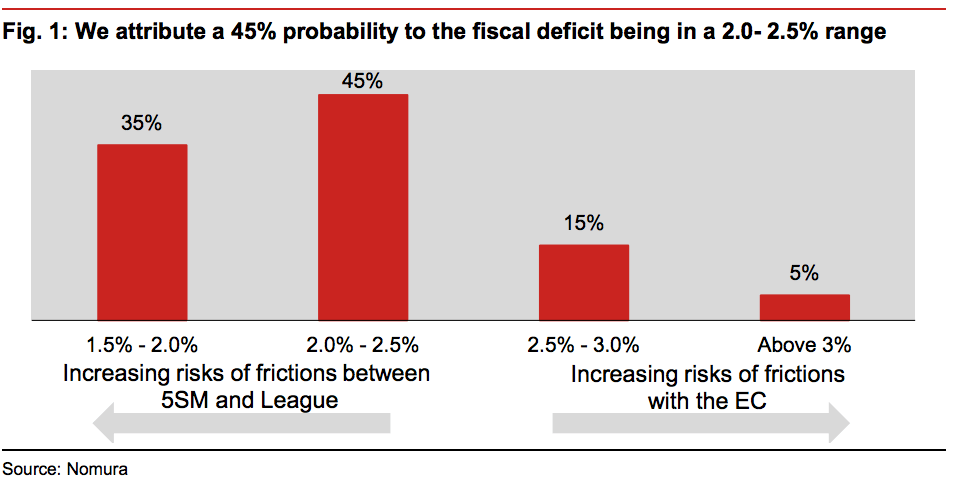

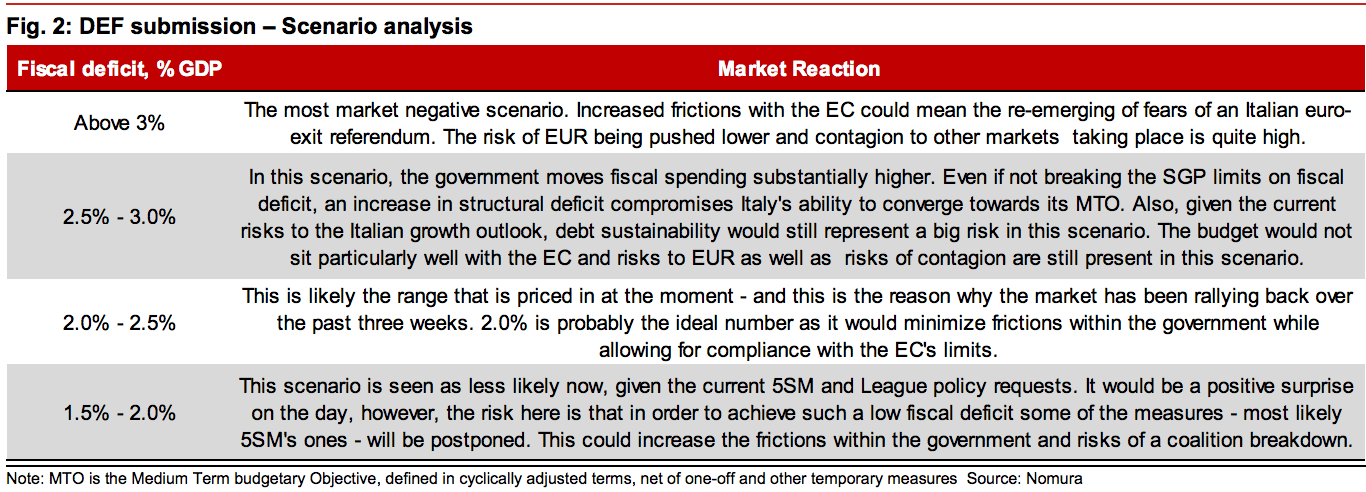

“Since this government was formed, fiscal deficit estimates have already ranged from 1.6% to above 3%. In our view, the most likely scenario will be a number between 2.0% and 2.5%.”

“The report that will be presented by the government tomorrow will be the result of a government meeting that will take place during the day.”

“The update to the DEF will not be made immediately available, as it needs to be presented before parliament first, and will most likely be published later on. However, it would be reasonable to expect a press conference following tomorrow’s meeting, during which the government’s members will present the updates to the macro figures included in the document and their new fiscal deficit forecasts.”

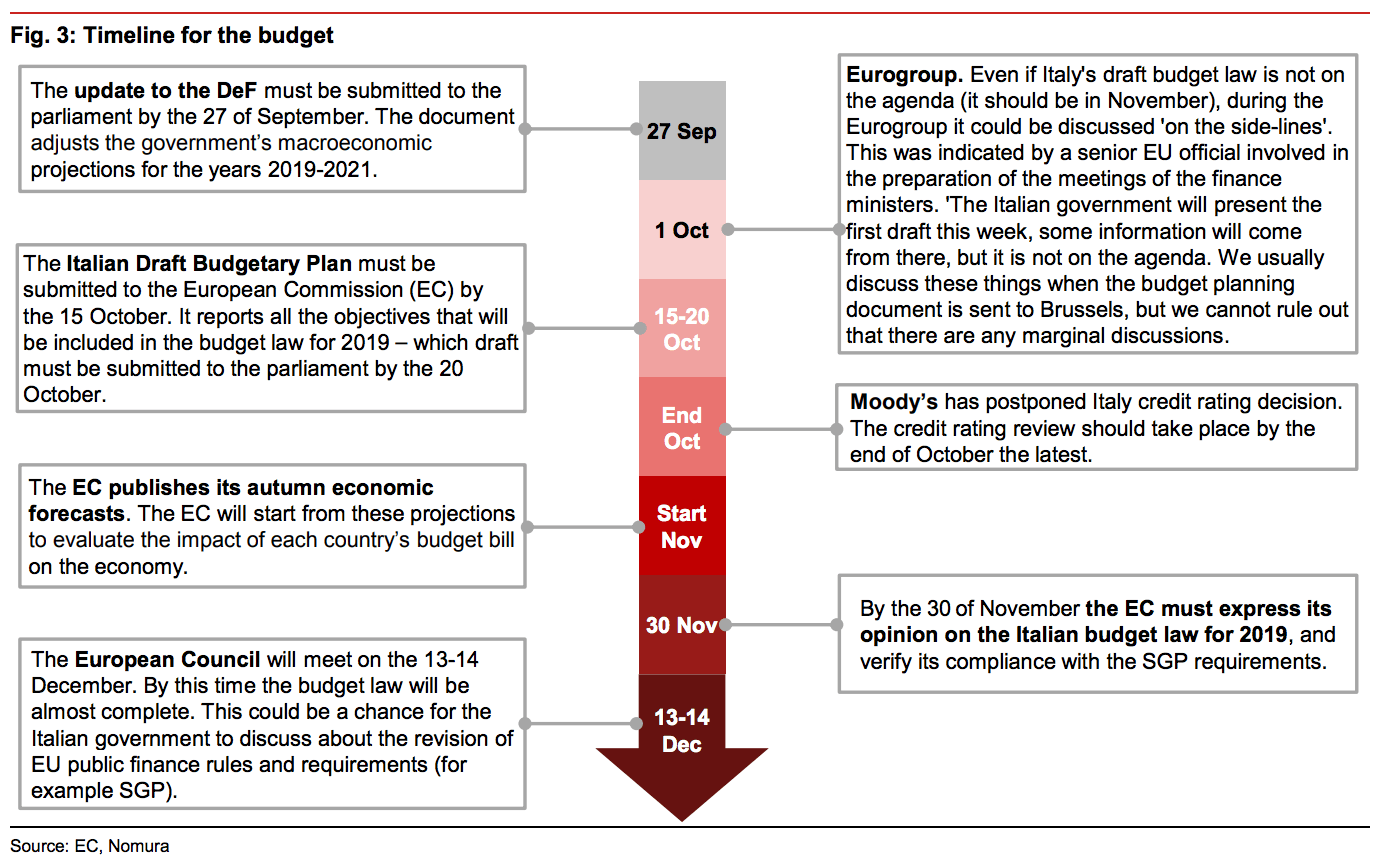

“The details on which measures will be implemented in the 2019 budget (i.e. flat tax, citizen’s income, pension reforms) will be limited, as it is worth noting that the update to the DEF is less detailed compared with the budget draft. More specific information on the measures to be implemented will be made available with the Budgetary Draft Plan that will be submitted to the EC before 15 October (see Figure 3 for a timeline for the budget). “

“A market-friendly scenario, in our opinion, would be a projected fiscal deficit of ~2%.”

“Such a figure would most likely allow for the implementation of 5SM citizens’ income plan, but at the same time respect, the EC Stability and Growth Pact limits without compromising public finances too much further. A number far above or below this poses different risks. As Figure 1 shows, a very high number would increase frictions with the EC and would question the sustainability of Italian debt in the medium term – most of all in a low-growth environment.”

“A too low number implies sacrificing part of the government’s reform agenda, and most likely 5SM’s citizens’ income. This would increase friction between the two main parties and between 5SM and Tria, with the risk of either Tria resigning or a coalition breakup. This is more a short-term risk, as ultimately we do not expect 5SM to push the envelope such that the coalition may break up before year-end. One reason for this is that 5SM has lost a lot of ground in the polls and now has an approval rate lower than the League – keep in mind that at the time of the elections 5SM was the first party within the coalition in terms of seats in both houses.”