- USD/JPY topped clocked six-month highs above 112.00 today, having scaled a key long-term falling trendline hurdle yesterday.

- The JPY call (bearish bets) value dropped to levels last seen on May 18.

The USD/JPY pair crossed the three-year-long falling trendline with strength on Wednesday and rose to a six-month high of 112.38 in the Asian session today.

The bullish breakout is likely forcing investors to ditch long JPY call positions (bullish bets).

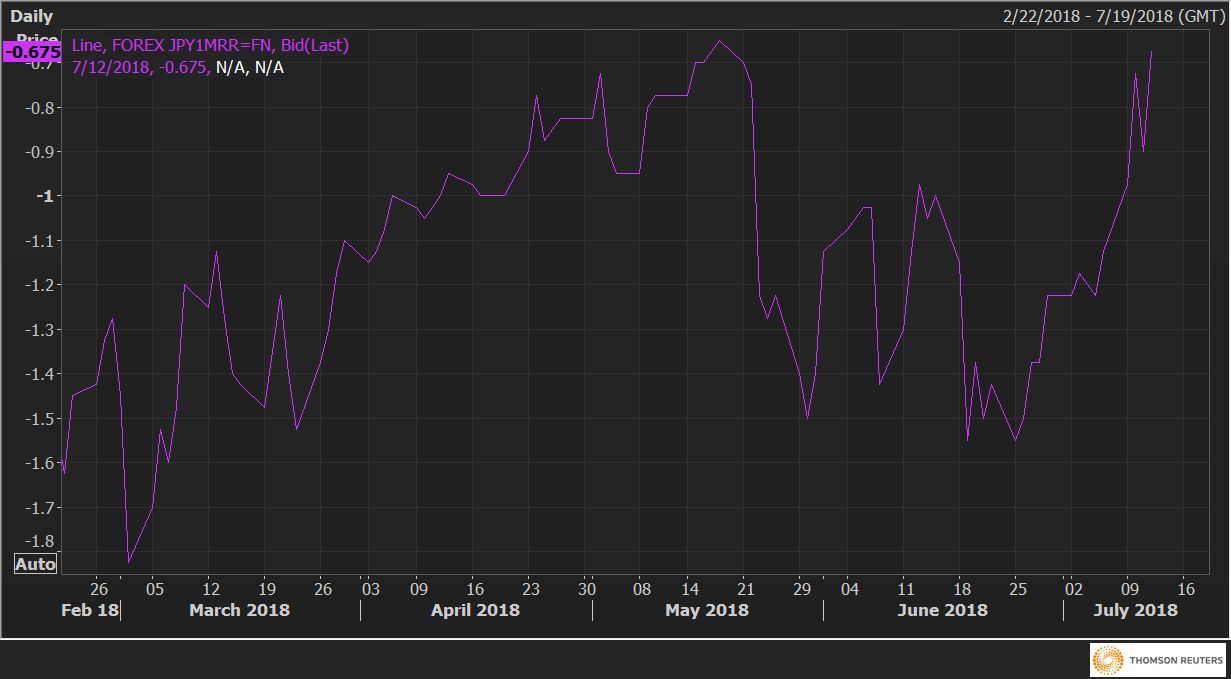

For instance, the USD/JPY one-month 25 delta risk reversals are being paid at -0.675 JPY calls – the level last seen on May 18. About 2.5-weeks ago, the risk reversals were being paid at -1.55 JPY calls.

The rise from -1.55 to -0.675 indicates falling implied volatility premium (falling demand) for cheap out-of-the-money JPY calls.

JPY1MRR