- USD: Focus on ADP report for steer on Friday’s employment report. Stronger number would be modestly dollar supportive. Minutes of Dec. FOMC meeting released 17:00.

- GBP: Lack of reaction to stronger manuf. PMI data yesterday showed sterling to be relatively immune to data releases at present.

Idea of the Day

From humble beginnings, the weaker yen story has gathered pace and now appears to be a phenomenon on a par with PSY’s Gangnam style video, with everyone jumping on board. This in itself is worrying as this makes the move vulnerable to a fairly sharp correction. The move on USD/JPY over the past three months is similar in magnitude (over 11%) to that seen in the wake of the Lehman’s collapse in late 2008 over a similar period and is likely to surpass it if this week’s gains on USD/JPY are sustained. The weekly CFTC data has been showing the (non-commercial) market short yen by the largest amount since mid-2007. This is only a proxy for a small part of the market, but the point remains that this does make the yen vulnerable to short-term correction(s), even for those who believe the bigger picture remains vulnerable to further weakness.

Latest FX News

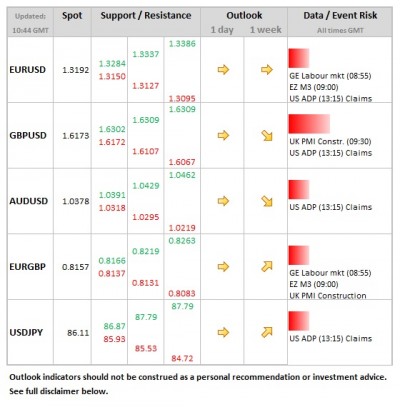

- JPY: Interesting to note that as FX sentiment turned later on during yesterday, USD outpaced JPY, so more cyclical highs on USD/JPY at 87.36, but beware risk of correction given extent of shorts.

- USD: Has gone from trading relief to looking at the overall taxation/spending picture and fractured political backdrop, which has seen the dollar trade higher on general risk aversion. Now waiting for equities to catch up.

- EUR: For now, the euro caught in the cross-fire between the dollar and the yen, which has seen EUR/USD pushed down towards the 1.3250 area in Asia trade.

- GBP: Data on house prices from Nationwide showing marginal fall (-0.1% MoM) in December, YoY at -1.0%. Cable new 16-month high at 1.6381 Wednesday, but moving away quickly thereafter.

- CNY: Stronger than expected non-manuf. PMI data released overnight, coming out at 56.1, which proved modestly supportive to equities in Asia.