- Litecoin price plummets more than 8% as the entire crypto market bleeds.

- LTC/USD needs to break above the short-term $52.00 resistance for it curve another path towards the supply zone at $56.5673.

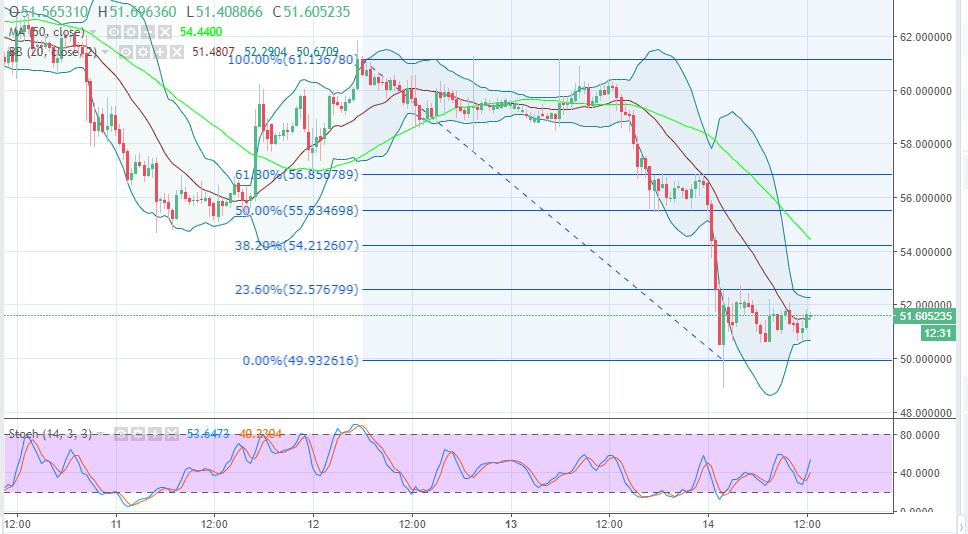

Litecoin is currently seeking balance above $50.00 following the overarching declines that took place during the afternoon and evening (GMT) trading sessions yesterday. The price plunged even further on opening the session today, Tuesday 14, mercilessly smashing through the short-term support at $56.00. The roll south continued throughout the Asian trading hours but slowed down considerably during the European trading hours while embracing the 50.00 support.

The subtle upside corrections in the wake of the declines have been capped at $52.00. LTC/USD is currently pivotal around $51.00 level. A weak bullish trend is forming with the stochastic advancing to the north at the 56% mark. The sellers, however, still have a tight grip on the price, which explains the bear pressure at $52.00.

A break above the short-term stubborn resistance at $52.00 will encounter more resistance at the 23.6% Fib level of the last drop from highs of $61.13 to lows of $49.91 at $52.5654. The ultimate intraday resistance lies at the upper supply zone at $56.5673. The support at $50.00, on the other hand, is very important to the bulls. They must fight tooth and nail to keep the price above this level. The Bollinger bands indicate a reduction in the volatility of the price. However, LTC/USD is still in danger of further declines below $50.00.

LTC/USD 30-minutes chart