- Litecoin extends breakout above the descending channel resistance in the 1-hour timeframe.

- The reversal on Friday following the Asian session is edging away from the bears.

- The full stochastic entrance into the overbought hints a reversal in the near-term.

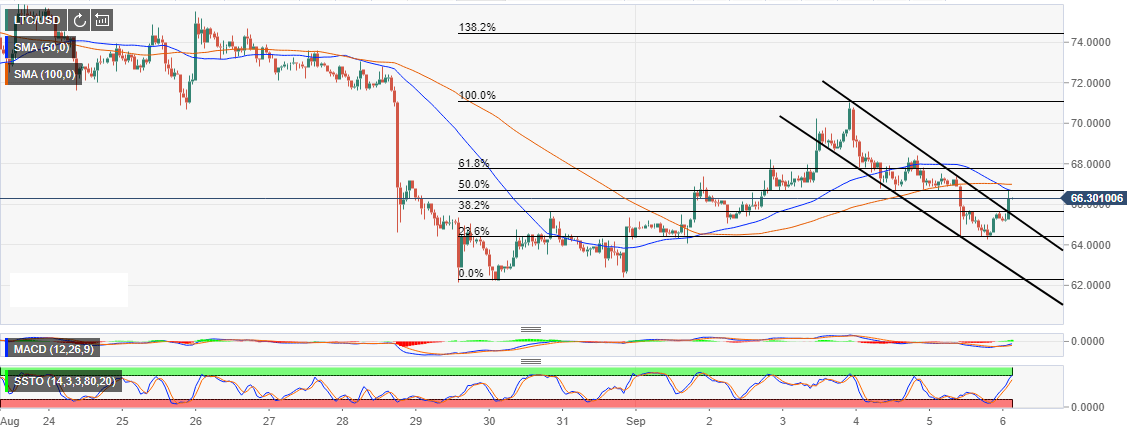

Litecoin came under heavy selling activity following a failed attempt to break the resistance at $72. The lower action within a short-term descending channel embraced the high concentration of buyers at the 23.6% Fib retracement level taken between the laws high at $71.0989 and a low at $62.31.

The reversal on Friday following the Asian session is edging away from the bears. Litecoin is trading above the channel resistance while the engulfing candle is battling with a confluence formed by the 50 Simple Moving Average (SMA) and the 50% Fib level.

The Moving Average Convergence Divergence (MACD) is in the negative zone but moving north. A step into the positive coupled with a positive divergence could suggest a stronger bullish presence. However, the full stochastic entrance into the overbought hints a reversal in the near-term. Therefore, a correction in the offing could test the short-term support at $66.00 before attempting another attack on $70 resistance and the supply zone at $71.14.