- LTC/USD needs to recover above $72.00 to tame bears.

- The initial resistance is created by $72.60 handle.

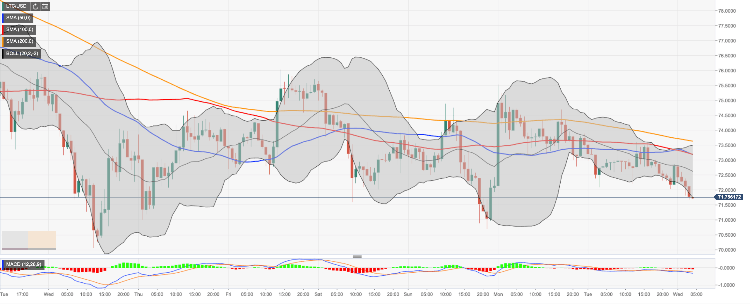

At the time of writing, LTC/USD is changing hands at $71.40. The coin is losing ground during early Asian hours amid strong bearish sentiments on the cryptocurrency market. Since the beginning of the day, LTC/USD has lost nearly 2% of its value and the downside momentum seems to be gaining traction.

Litecoin is now the fifth-largest digital asset with the current market value of $4.5 billion and an average daily trading volume of $2.4 billion.

Litecoin’s technical picture

On the intraday charts, a move below psychological $72.00 bodes ill for the coin. We will need to see a sustainable move back above that handle to mitigate an initial bearish pressure.

The initial support is created by the intraday low of $71.67 with the lower line of 4-hour Bollinger Band located on approach. Once it is out of the way, the sell-off is likely to gain traction with the next focus $71.00 and psychological $70.00. This long-term support area is likely to attract new buyers and stop the sell-off.

On the upside, once above $72.00, LTC/USD may extend the recovery towards $72.60 (the middle line of 1-hour Bollinger Band) and $73.00 with SMA50 (Simple Moving Average), SMA100 1-hour and the middle line of 4-hour Bollinger Band located right above that handle. Once it is out of the way, the upside is likely to gain traction with the next focus on $73.60 (SMA200 1-hour and SMA50 4-hour) and $74.00.

From the longer-term perspective, LTC/USD continues moving within a range limited by $70.00 on the downside and $76.00 on the upside.