- “The reason for the delay is the lack of a prohibition on money laundering,” said Jacob Enoch, co-chair IBA.

- Cryptocurrencies suddenly reverse trend to the downside, there is potential for more gains.

Most of the major cryptocurrencies have begun correcting lower on Friday. The downside movement is being led by the King of the virtual currencies, Bitcoin which is down $1.13% on the day while trading at $7,405. The other assets have also followed in the steps of Bitcoin, for instance, Ethereum price is trading at $574 while it is correcting lower a subtle 0.39%. Moreover, Ripple price has not been left behind, it is down 0.18% but is it is still supported above $0.60.

The latest news from Israel says that the country has decided to delay regulations that had been scheduled to take effect on June 1. The decision was arrived at after a meeting held by the finance committee of Knesset: The arm of the government in charge of legislation. The co-chair of Israel Bar Association (IBA) Jacob Enoch in an e-mail to the news website, Cryptovest said:

“The reason for the delay is the lack of a prohibition on money laundering, which implies that these companies have not been mindful of, and have not acted to prevent, money laundering to this day. This is something that is not acceptable to say about an entire market.”

Enoch went ahead to say that this move is rather dramatic and will only be beneficial to the large financial institutions. These institutions are wary of the competition that is bound to come after regulated FinTech firms start to operate in the country. He said in conclusion:

“One can only hope, that such inevitable antagonism among fintech investors will not snowball into a potential loss of trust,”

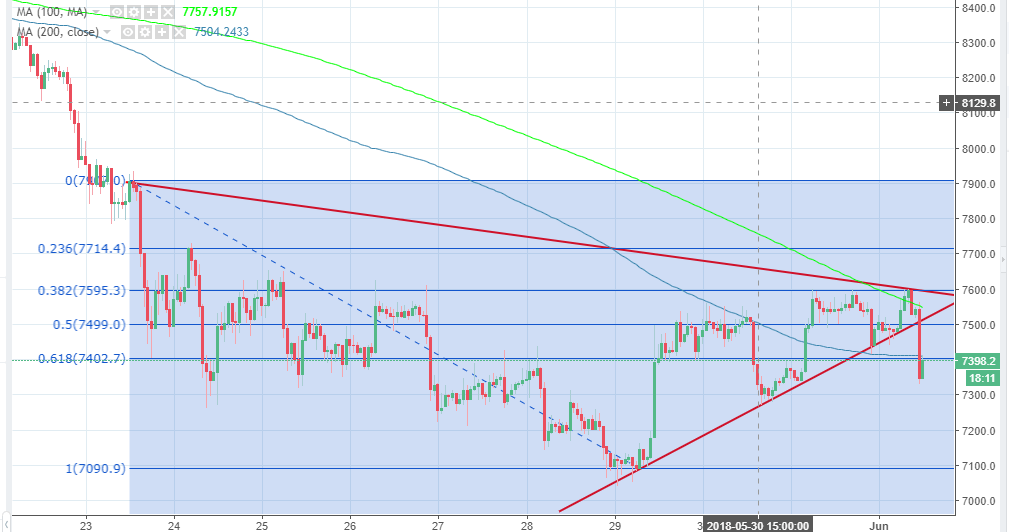

Bitcoin price short-term analysis

Bitcoin price has broken out of the short-term contracting triangle we explored earlier in the previous hour. Moreover, breaking past the 61.8% Fib retracement level opened the gate for the price to test the support level at $7,300. BTC/USD is trading at $7,398, besides there is a reactive bullish momentum that is battling to reverse the sadden downside movement. The 200 SMA failed to support the price above $7,400 will offer resistance as the price retraces steps towards $7,500.

BTC/USD 1-hour chart