Idea of the Day

The market starts playing catch-up today with the US Employment report for September, usually released on the first Friday of the month, out today. The market expects a 180k in headline payrolls, with the rate holding steady at 7.3%. The survey for this was undertaken before the shutdown took effect, so the dilemma will be is that if we do see data stronger than expected, the extent to which subsequent developments have undermined any strength in the economy. The dollar itself has been very weak of late, undermined by recent events and also the continued uncertainty regarding the longer-term fiscal outlook in the US. A firmer number would be dollar positive, but probably not massively so.

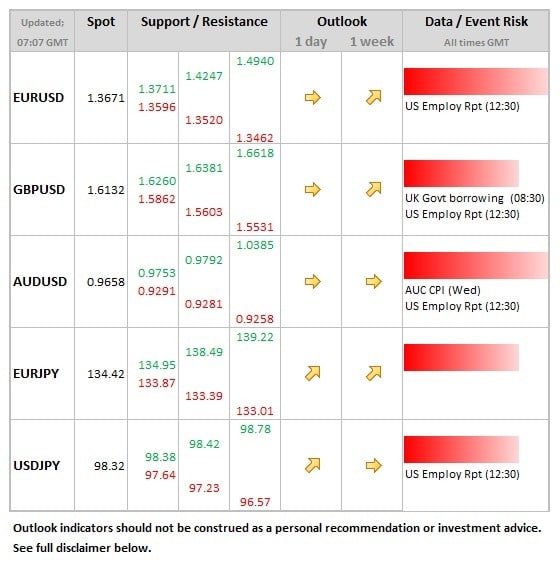

Data/Event Risks

USD: There are opposing forces in terms of the impact of the US data on the dollar. Markets have been devoid of government released data so far this month, so are desperate for news. That said, this is for September, so does not include the impact of the latest shutdown. There will be both transitory and more sustained impacts, so that will be something for next month’s data released. The market looks for 180k gain in headline payrolls, with the unemployment rate steady at 7.3%.

AUD: Inflation data is released on Wednesday. The headline rate is seen falling from 2.4% to 1.8%. This is principally because inflation very strong in Q3 last year, rising 1.4% on the quarter, whereas this time the quarter increase is seen at 0.8%. Anything firmer should provide firmer modest support for the Aussie, but it is looking a little stretched after recent gains.

Latest FX News

JPY: A drift higher on USDJPY overnight, but ranges were understandably tight ahead of the payrolls data later in the day.

CNY: The recent appreciation of the Yuan cut down overnight, with the PBOC’s fixing pushing USDCNY higher from the lows of the year. Latest data on property prices not surprisingly showing buoyant prices in major cities.

AUD: Lower yesterday against the US dollar for the first time in nearly 2 weeks. Looking a little over-bought after such a push higher, but likely to be supported going forward by still decent sovereign fundamentals.

Further reading: