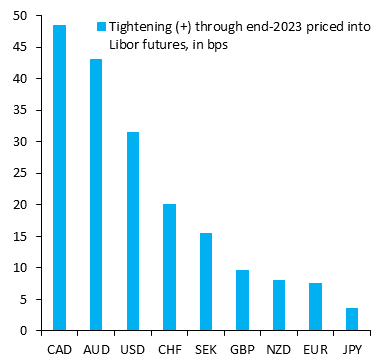

The London interbank offered rate (LIBOR) futures chart tweeted by Robin Brooks, Chief Economist at the Institute of International Finance, shows that markets are pricing a “lift-off” for commodity-rich regions such as Canada and Australia through the end of 2023.

Lift-off refers to the increasing of interest rates by a central bank after a period of no change.

The data indicates confidence in the ongoing recovery in the global manufacturing cycle. The global economy is widely expected to bounce back in 2021 and 2022 on coronavirus vaccines.

However, Japan and Eurozone, which face mounting deflation risks, are expected to keep the interest rates at record lows for a prolonged period.

“This differentiation theme will really get going once we have wide-spread vaccinations,” Brooks said.