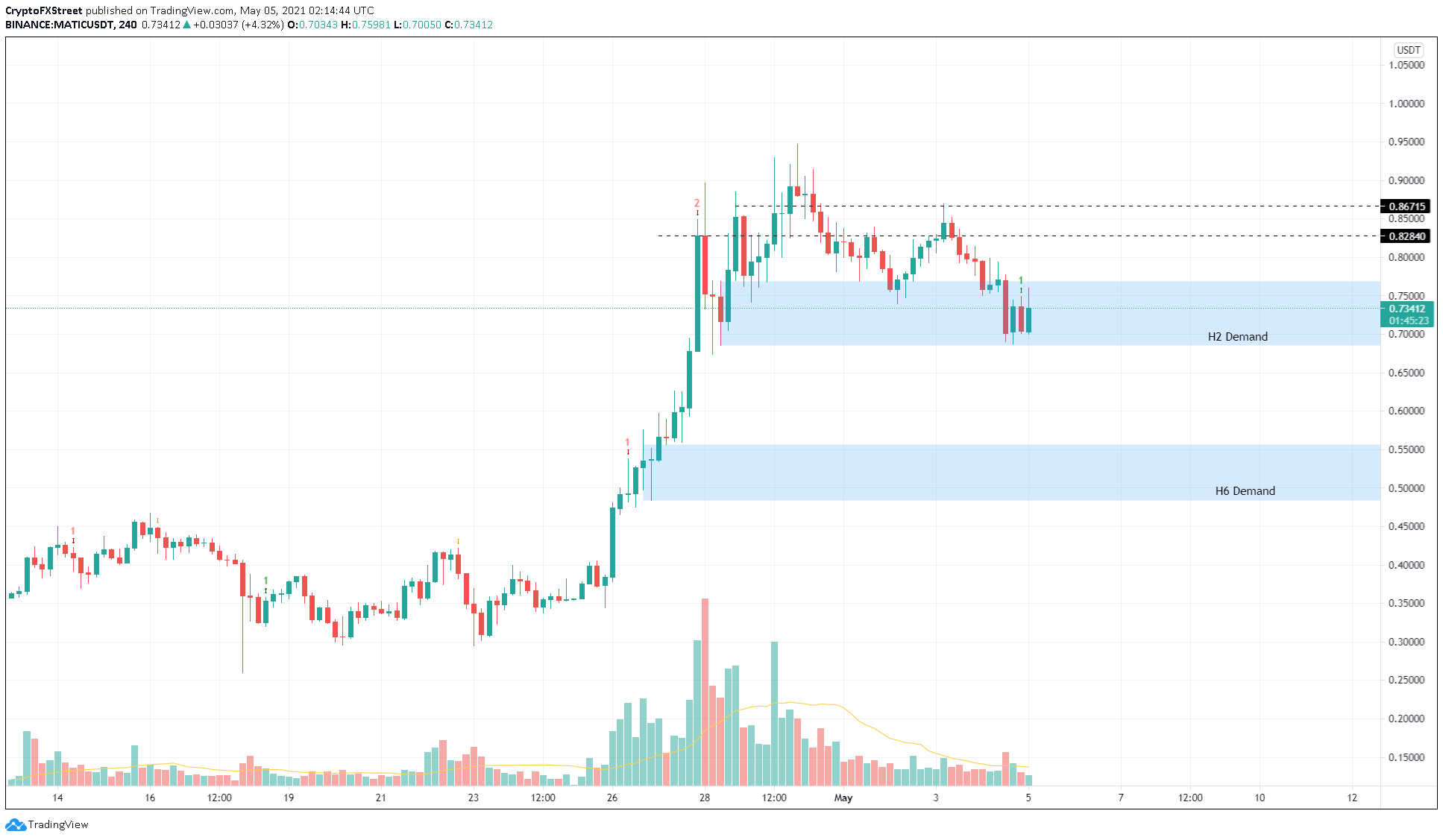

- MATIC price is trading inside a demand zone that extends from $0.685 to $0.768, awaiting a bounce.

- The MRI has flashed a buy signal, indicating a reversal in the downtrend.

- Polygon eyes a 12% surge to the immediate resistance level at $0.828 but could extend its rally to $0.872.

MATIC price saw a steep downtrend in under 48 hours that has pushed it to a critical support barrier. Now, a resurgence of buyers could start its uptrend toward the recent swing highs.

MATIC price to kick-start new upswing

On the 4-hour chart, MATIC price shows that it is finding a foothold deep inside a demand zone that ranges from $0.685 to $0.768. A spike in buying pressure here could push Polygon out of this containment and set the stage for a new rally.

Supporting this quick run-up is the Momentum Reversal Indicator (MRI), which flashed a green ‘one’ candlestick. This setup projects a one-to-four candlestick upswing.

Hence, investors can expect buying pressure to pick up. In such a scenario, the MATIC price could rally toward the first resistance level at $0.828, a 12% upswing from its current position.

A breach of this barrier could see Polygon rally to $0.872.

While MATIC price could stay range-bound between $0.685 and $0.872, a decisive breach above the upper end could see a retest of its all-time high at $0.94.

MATIC/USDT 4-hour chart

Regardless of the bullish indications, if MATIC price slices through $0.685, it stays below this area for an extended period. Investors could expect an invalidation of the bullish thesis for a short period.

If this were to happen, Polygon could slide 10% to the demand barrier at $0.618.