1) Fundamental

Today: The Markit Manufacturing PMI will be released for both France and Germany.

The manufacturing sector dominates a large part of GDP. Results above 50 will be bullish signals for the EUR, whereas anything less than 50 will be bearish.

Wednesday: Canada will take center stage with the Bank of Canada (BoC) Interest Rate

Decision. If the BoC adapts a hawkish approach and raises the previous rate of 0.5%, this will have a bullish impact on CAD. If the BoC goes the way of the doves and maintains the current rate, we’ll be looking at a negative impact on CAD.

Thursday: We will witness on Thursday another OPEC meeting in Vienna. Any big news out of here will be important for those looking to make a move in oil this week.

Friday: It’ll be Friday before you even know it and I will be looking towards the US where GDP data will be coming out for Q1 of 2017. Higher GDP equals a stronger economy. How will this news affect your EUR/USD positions? Let’s have a look at some technical now.

Technicals:

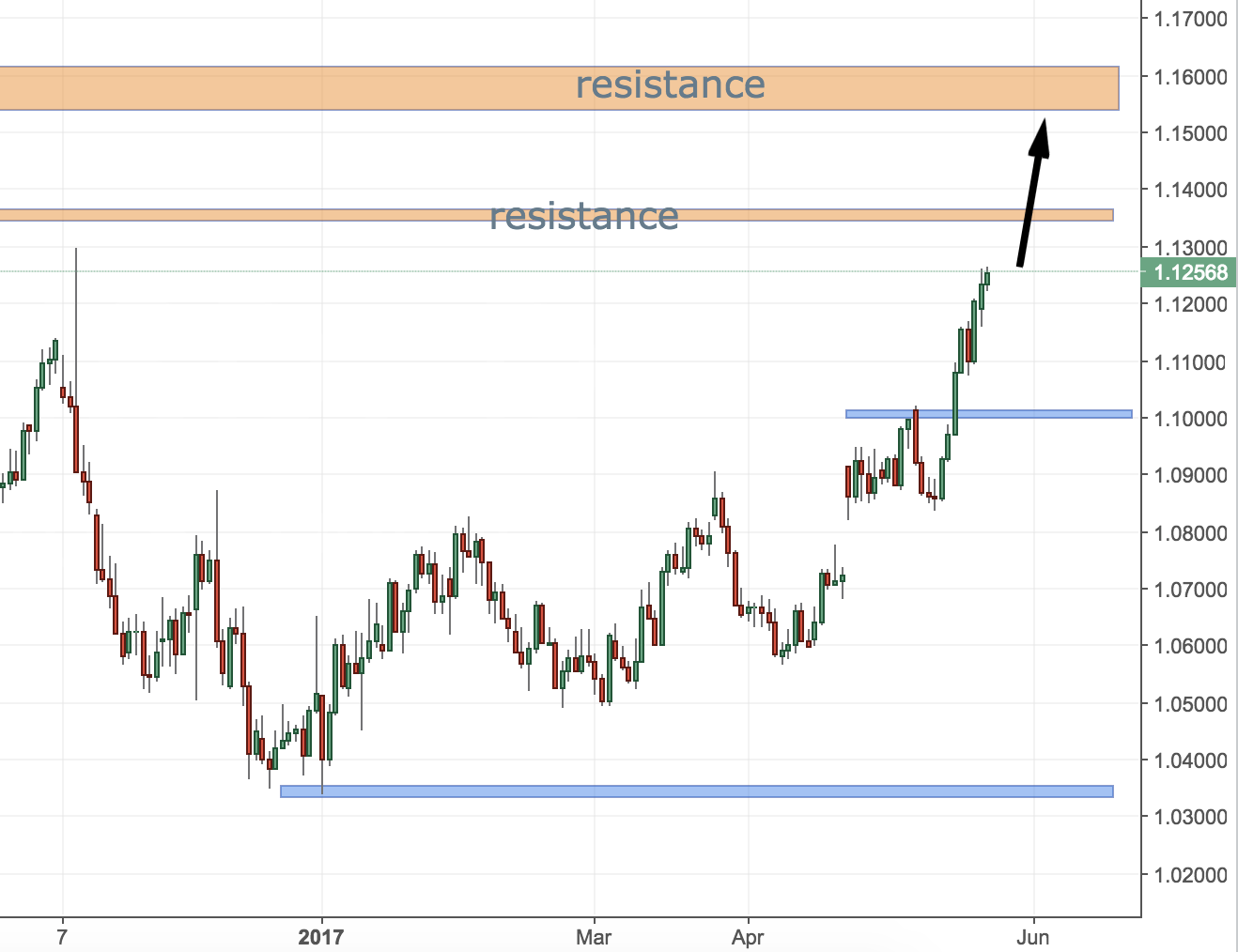

EURUSD– I am looking at the EURUSD and all I see is bullish action. In the last 9 trading (Daily) sessions, we had 8 bullish candles. The closest resistance area is 1.1400 and the next major level is at 1.1600. I don’t see a technical reason of why the price won’t be able to reach these levels in the following trading sessions.

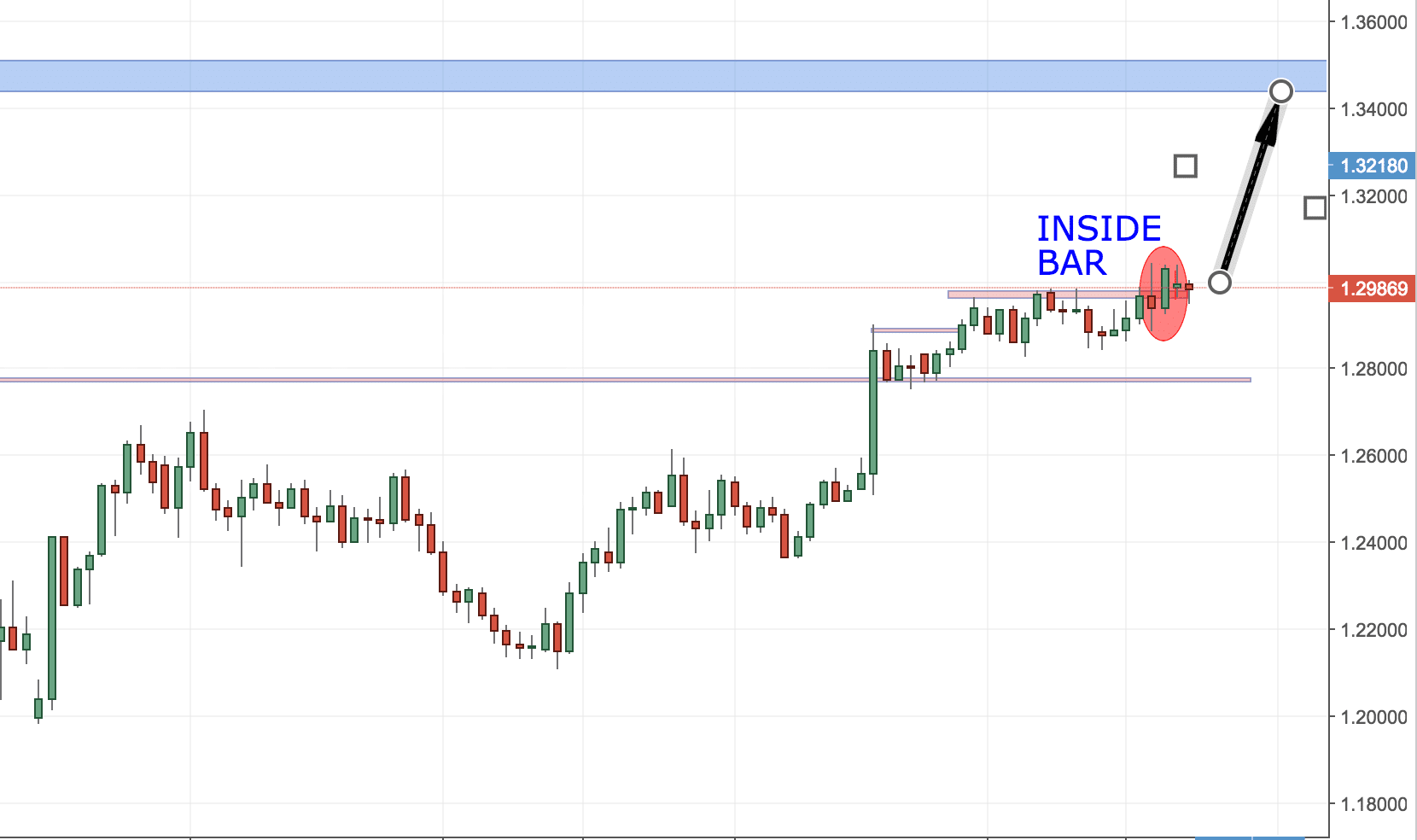

GBPUSD– The price action of this pair is showing me bullish connotations. There was an inside bar on the Daily chart that formed on Monday. Price seems to be spending some time around the 1.3000 area, but that is totally normal. The market is waiting for the UK election results from the 8th of June, so we might see more hesitance until then. From a technical point of view, the next resistance area is at 1.3500. The secondary resistance (price target) is at the level of 1.4000.

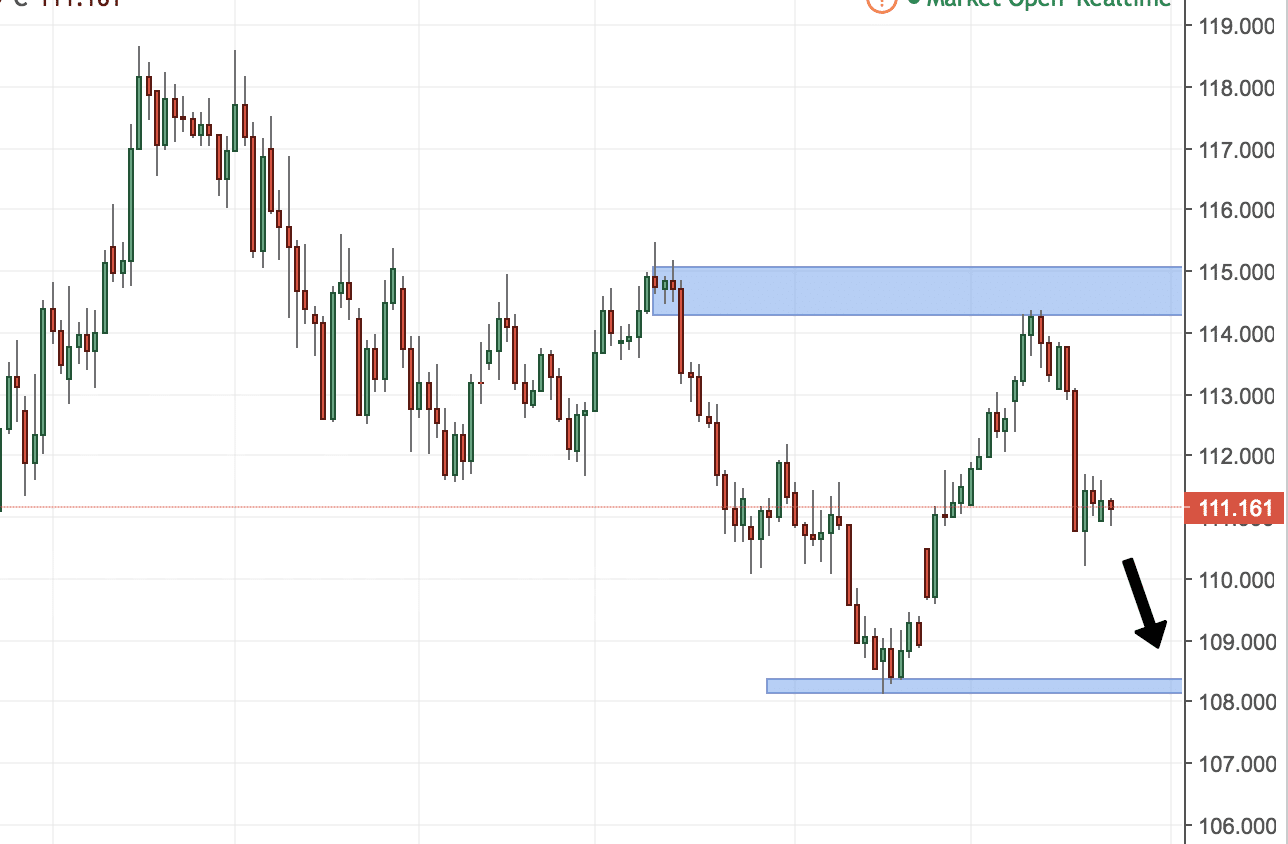

USDJPY– The USDJPY is locked in a range between 108.00and 115.00. I am expecting to see the price reaching to the 108 handle first, before we see more clear sign of direction.

Whatever instrument you choose to

focus on this week, I wish you only success! Good luck and don’t risk more than 1-2% of your equity on every single trade.

Guest post by colibritrader