- Mina price has jumped over 20% in price over the last 7 days.

- MINA’s market capitalisation has also grown taking the asset among the top 100 cryptos

- The Mina token was listed on Binance on August 11.

Mina price has jumped over 20% in price over the last 7 days. This rally has caused MINA to be ranked among the 100 top cryptocurrencies by market capitalisation. It currently sits at #60 from # and is 111 last week being among the leading the cryptocurrency boom experienced recently.

Binance listing Bolsters MINA Price

According to data from TradingView and Cointelegraph pro, Mina has been among the biggest gainers over last one week rallying 47% from 2.36 on August 10 to the current price at $3.45 This rally was sparked by an announcement by Binance on August 10 that it will be listing innovative token in the Innovation Zone from August 11, 2021.

The announcement that was made on the Binance website asked traders to start depositing MINA into their Binance wallets before the token went live on the largest crypto exchange on August 11.

“Users can now start depositing MINA and RAY in preparation for trading. Withdrawals for MINA and RAY will open at 2021-08-11 06:00 AM (UTC). …withdrawal open time is an estimated time for users’ reference. Users can view the actual status of withdrawals on the withdrawal page.”

The announcement also stated that the listing fee of Mina on Binance was free (0BNB).

MINA Nurtures A Rounding Bottom Chart Pattern

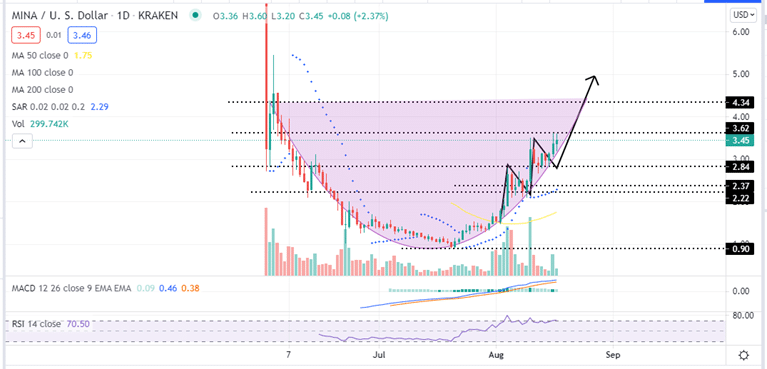

MINA appears to have formed a rounding bottom pattern on the daily chart after the sell-off was halted at $0.90. Note that this pattern forms when an asset initially descends toward a low indicating an excess of supply. The reversal to an upward trend occurs when buyers enter the market at a low price, which increases demand for the asset. Once the rounding bottom is complete, the asset breaks out and will continue in its new upward trend.

The rounding bottom pattern is used in technical analysis to indicate a bullish market reversal. In case of the Mina Price, a breakout from the rounding bottom pattern will be confirmed when MINA closes above the price immediately prior to the start of the initial decline. In this case the $4.34 mark. If this happens, could explore the $5.0 psychological level.

MINA/USD Daily Chart

Realise that the trading volume ideally follows the direction of the asset price in a rounding bottom chart pattern. The volume of the asset traded usually peaks at the beginning of the decline and when it reaches its previous high with building volumes on the approach. This is confirmed by MINA’s trading volume from the same daily chart. Realise that Mina’s trading volumes reached their lowest point when the trough reaches the bottom on July 12.

Apart from the technical chart pattern, the parabolic SAR remains positive since July 23 adding credence to the bullish outlook. This bullish thesis is further accentuated by the position of the MACD in above the zero line in the positive zone and the position of the Relative Strength Index in the overbought region.

Note that a daily closure above the immediate resistance at $3.62 is crucial to sustaining the bullish bias.

Can MINA’s Bullish Bias Be Invalidated?

Closing the day under yesterday’s opening price at $3.13 will invalidate the recovery efforts and trigger another sell-off, resulting in another correction towards the $2.84 or the $2.22 support areas respectively.

- If you are seeking to buy MINA, this list of crypto brokers might be helpful.

What is MINA?

Mina is a layer-1 blockchain protocol designed to curtail computational requirements in order to run decentralised applications (dApps) more efficiently. The size of the Mina blockchain is designed to remain constant at 22kb, regardless of growth in usage. Mina blockchain’s native token is MINA and is used for network transactions, staking rewards, and block production.

Looking to buy or trade Mina now? Invest at eToro!

Capital at risk