Idea of the Day

Last night the FOMC gave with one hand and took away with the other. It gave by adjusting its pledge to keep rates low so long as unemployment remains below the 6.5% level. There had already been doubts as to whether this was the right level and by doing this, the Fed has further removed the fear of tightening that was present in the market in September. The Fed took away by reducing the amount of its monthly bond purchase by a modest USD 10 bln. This was not fully expected by any means, but was a significant risk, as we highlighted yesterday. The adjustment in the employment threshold and small tapering amount meant that the initial impact on the dollar was modest, with some reversal of dollar strength seen. The belief that tapering will be dollar positive has been dented.

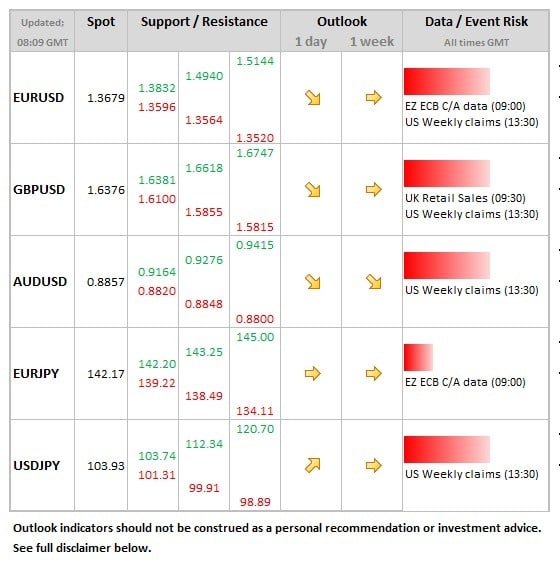

Data/Event Risks

USD: Claims data today likely to be ignored by market again given the recent volatility, so dollar should not be impacted.

Latest FX News

Gold: As with the dollar, the reaction on the gold price has been modest to the Fed’s tapering. Spot gold has rested just above the $1,220 level in Asia trade. The fact that 10 year bond yields only increased 5bp in response to the news is also supportive.

GBP: The surprise fall in the unemployment rate yesterday to 7.4% is something of a game changer for sterling. The Bank of England had stated it would not consider raising interest rates at least until the 7% threshold was reached. Sterling has been one of the currencies that held up well against the dollar, on the thinking that the UK is potentially that much closer to raining interest rates.

Further reading:

Analysis: Sweet Dectaper is still a taper – USD has the upper hand

Bernanke’s presser: QE could end in late 2014, sees case for somewhat stronger inflation