- Fifth consecutive daily rise for NASDAQ price

- 15500 ATH is next realistic resistance target for the US100

- International turmoil and high inflation worries seem to have been shrugged off by investors

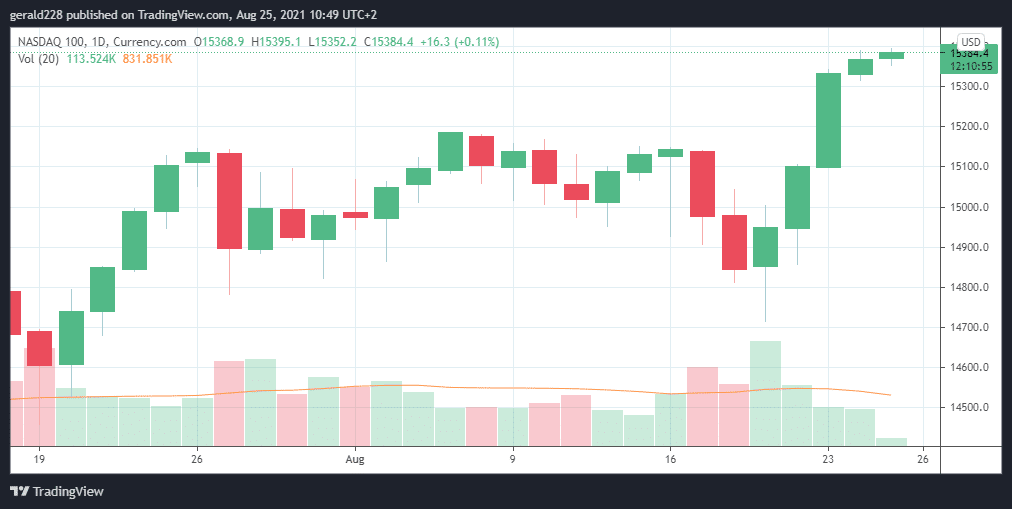

The NASDAQ price is once again on a roll after a brief period of retracement last week. The US100 is up for the fifth consecutive session and has appreciated by a considerable 2.5% since 19 August or a gain of over 500 points.

Although the international situation appears to still be somewhat worrying with the Taliban enforcing the deadline for withdrawal of civilians, investors have largely shrugged off such concerns. The spectres of high inflation and a tepid economic recovery have not had too much effect either.

All investor eyes continue to be focused on the Jackson Hole meeting starting tomorrow where FED Chair Jerome Powell is expected to announce the strategy for tapering off economic support in the coming months. Investors seem to have priced this in already however.

If you haven’t started trading forex yet then take a look at this Forex Trading For Beginner’s Guide.

Short Term Prediction For NASDAQ Price: More Bullish Sentiment Expected

Although the Afghanistan situation slightly derailed the stock market’s inexorable surge over the past week, it appears that normal service has been resumed over the past few days. During the last five sessions, the NASDAQ price gained over 500 points which is pretty impressive considering all the concerns that could affect markets.

The ascending triangle that began on July 20 appears to be intact with the NASDAQ price rising almost 5% since that level. If the bullish scenario were to continue, then the US100 should begin to tag the 15500 level quite fast. If this resistance level were to be overcome, then the next price point where more obstruction could be found would be the 15750 mark. This would represent a considerable gain of around 4% from the current price.

If on the other hand, a bearish thesis were to come into play, the NASDAQ price would descend to around the 15200 level where strong support may be expected. If Fed Chair Powell’s speech may not be what the market expects then we could see a small sell off although as remarked earlier, this seems to have been quite priced in.

If you want to start trading forex but haven’t done so yet, then you should take a look at these Top Forex Brokers.

Long Term Prediction For US100: Slow But Inexorable Rise Expected To Continue

Although many pitfalls remain, the NASDAQ price is expected to continue appreciating until the end of the year. The Covid19 situation is still a worry with case numbers on the rise in several states and a correspondingly slow vaccination programme in these areas.

However, the situation in Afghanistan has shown that short term blips do not really have much of an influence on the stock market as a whole. With tech stocks seeing continued demand, the long-term future of the Nasdaq looks bright.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.