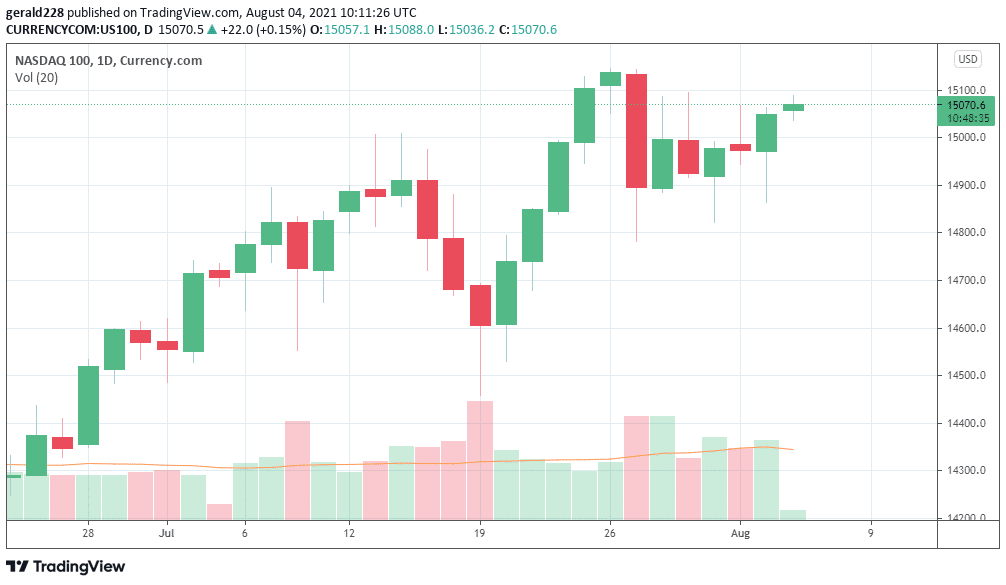

The NASDAQ price seems to be once again looking towards positive price movement as it leaps over the 15000 level and another all time high. After descending on the July 27 session, the NDX100 has recovered well even after a slightly slow start to the week.

It is expected that the sluggish pace on vaccination and a resurgence in Covid19 cases will continue to have a drag effect on the economy. However, investors seem to have shrugged off these bad vibes and are continually piling into stocks with prices rising exponentially.

If you haven’t yet started trading forex then you should have a look at these Best Forex brokers and get some ideas.

Short Term Prediction For NASDAQ Price: Gains expected to continue

Although inflation continues to remain high, it seems that the NASDAQ is not resting on its laurels. With most tech stocks issuing profit warnings over the next half of the year, investor sentiment should theoretically be slightly lukewarm, but this does not seem to be the case.

The NASDAQ price is expected to continue rising slightly in the short term with the 15500 level being the point of next resistance. The Fed’s continued doveish policy on bond purchases might start tapering ff however and this may start a slight retracement in the NASDAQ price for the short term. However, the ascent in the tech index which started on 25 June seems to be largely in place.

A combination of weaker than expected economic data and a resurgence of the Delta variant in the US means that tech stocks seem to be favoured, at least in the short term.

Daily forex trading is an interesting option if you want to try out this alternative method.

Long Term Forecast For NDX100: More Growth Expected

As already indicated, a combination of sluggish GDP growth and a strong resurgence of Covid19 cases, particularly in states with lagging vaccination programmes are favouring tech stocks and hence the NASDAQ.

Comparing the Dow Jones to the NASDAQ indicates that the latter is outperforming the broader US index. Lockdowns in large countries where a resurgence in the Delta variant is causing concern also has a negative effect on cyclical stocks which is the larger component of the DJ.

The general expectation for analysts is that investors will continue to favour tech stocks even on a long-term basis. The crucial non-farm labour payroll report due on Friday will undoubtedly be closely looked at to provide a further indication of the economy’s performance.

The NASDAQ price is expected to end the week in positive territory with a brush up to the 15100 level not unlikely.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.