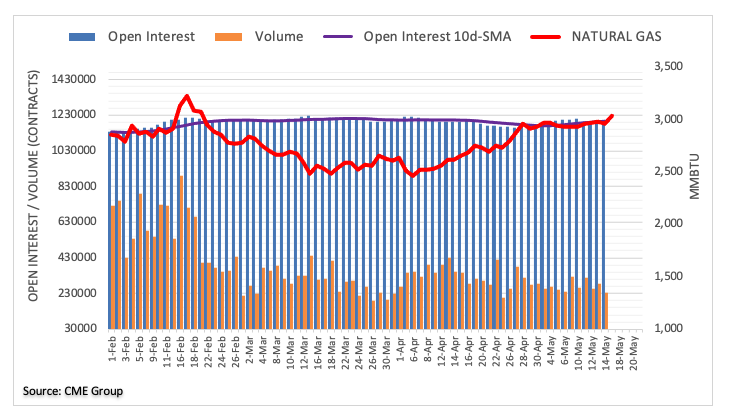

According to advanced prints from CME Group, open interest in Natural Gas futures markets went up for the second straight session on Friday, this time by around 1.4K contracts. Volume, on the other hand, dropped by around 46.1K contracts, reversing the previous day’s build.

Natural Gas still stays capped by $3.00

Prices of Natural Gas failed once again to test/surpass the key $3.00 hurdle on Friday, closing the session with modest losses. The downtick was accompanied by rising open interest, indicative that a probable correction lower lies ahead in the very near-term. On the flip side, the upside momentum is expected to gather extra steam once the $3.00 mark per MMBtu is cleared.