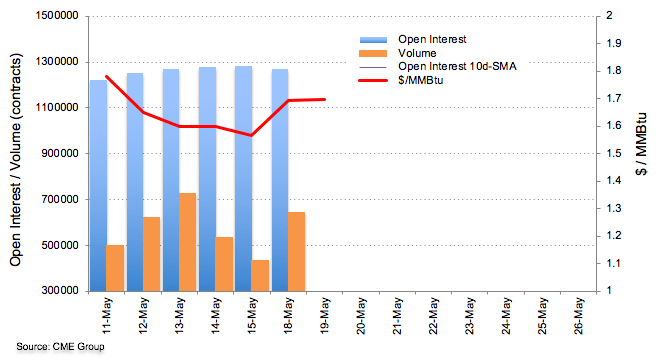

CME Group’s preliminary readings for Natural Gas futures markets noted open interest shrunk by around 15.7K contracts on Monday while volume reversed two consecutive daily drops and increased by around 212K contracts.

Natural Gas Prices Forecast

Prices of the MMBtu of the commodity have managed to rebound from monthly lows in the $1.56 neighbourhood, largely on the back of the broad-based better mood in the riskier assets, including a sharp rebound in crude oil prices. The recent upside in prices was in tandem with decreasing open interest, suggesting that extra gains could lose some traction in the very near-term.

The ongoing bounce in prices is flirting with the 55-day SMA around $1.73 and the next target of relevance is seen around $1.83, where sits the 100-day SMA. Further north emerges the 4-month peaks above $2.05 recorded in early May. The sustainability of further recovery is yet to be seen, however, as Natural Gas faces oversupply concerns, loss of demand and storage capacity nearing its maximum levels.