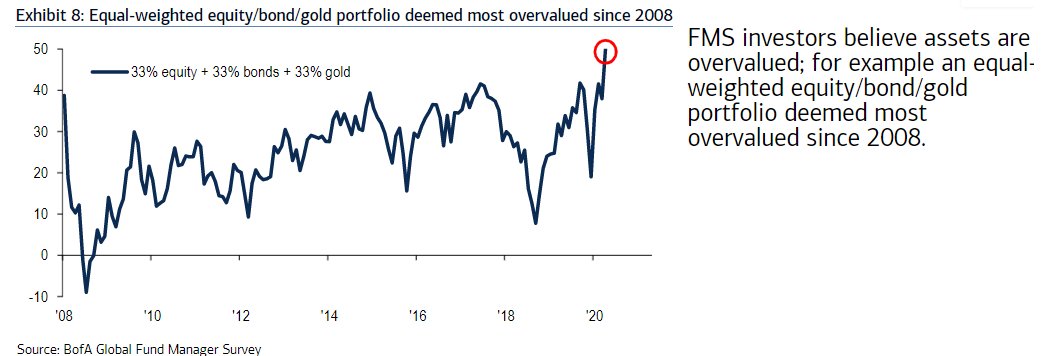

The percentage of global fund managers who believe most asset classes are overvalued has risen to nearly 50% – the highest level since 2008, according to a Bank of America (BofA) fund manager survey released on Tuesday.

Key points (source: Business Insider)

Investors are most bullish on since the February start of the pandemic-induced market sell-off.

The sentiment is still “far from dangerously bullish”.

The most crowded trades among portfolio managers include long US tech stocks and long gold.