The US dollar is looking somewhat balanced and looking for a new direction. What could be the next driver? The team at Morgan Stanley points to real yields, and explains:

Here is their view, courtesy of eFXnews:

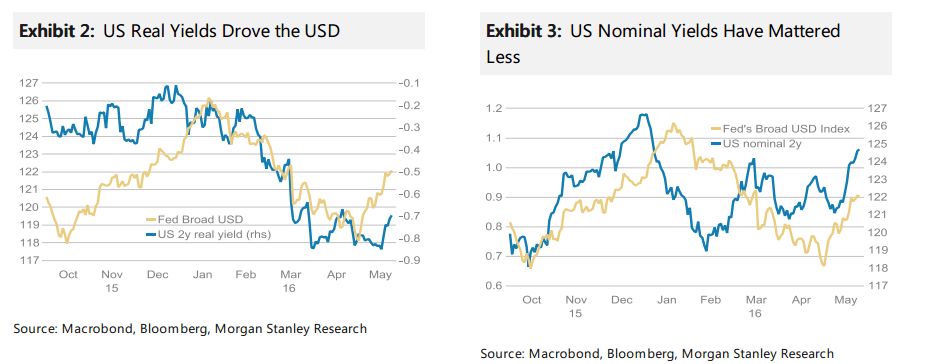

We believe the next catalyst for the USD appreciation will be an increase in real yields, which in our view have become the dominant driver of the currency, rather than nominal yields.

Evidence that the US output gap is narrowing should prompt higher US real yields and a stronger USD.

Given weak growth and low inflation expectations, real yields in Europe and Japan could do with staying low; however, with nominal yields already in negative territory there will in fact be a tendency for real yields to rise in Europe and Japan as inflation expectations fall. This should keep EUR and JPY strong.

For many EMs, especially those with weak fundamentals and external vulnerabilities, the relationship is inverse.

As real yields increase in the US, we’d expect EM currency weakness and an increase in EM real yields. The exceptions are the DM-like EMs, such as Korea, where we’d expect an eventual drop in real yields to drive KRW weakness.

Risk events on the horizon.

Rising US rate expectations support our bullish USD call, however not just in the context of higher nominal yields. In an environment of slowing global earnings, trade and growth, the manufacturing drag could again come into focus with Korea trade data and China’s PMI due next week. Any resulting equity market weakness should support the short GBP and KRW trades in particular.

FX investors will also be waiting for Yellen’s speech on June 6, with a hawkish tone adding to USD strength. EUR should be stable from an ECB unlikely to change course.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.