We don’t usually comment on the Norwegian Krone, but this move is certainly special: the Norwegian Central Bank cut the interest rate from 1.50% to 1.25%. USD/NOK is at levels last seen 6 years ago, and quite close to levels last seen in 2003.

This accelerated the falls of the northern currency, which had already suffered significant drops together with the falls in oil prices. EUR/NOK leaps above 9. USD/NOK is at 7.25, the highest since late 2008:

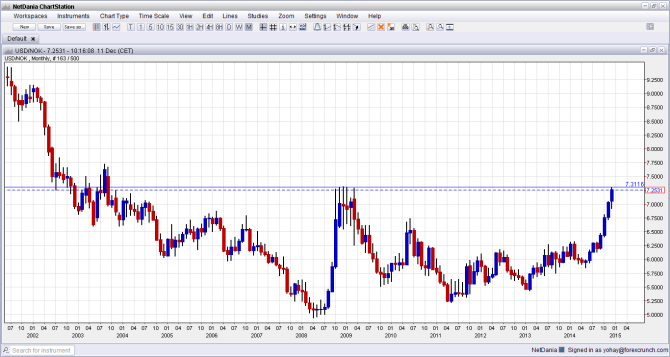

Here is how it looks on the monthly chart. Note that Dollar/NOK is at very close to the stubborn highs of 7.31 seen at the peak of the financial crisis. A small move higher and we have levels last seen in 2003, over a decade:

The rest of the Norwegian economy is doing quite well, with low unemployment and a boom in construction.

The Canadian dollar is also suffering from the fall in oil prices with USD/CAD battling the 1.15 line. Like Norway, the local economy is doing well as well.