The British pound suffered long days of falls against the dollar and also against the pound.

Nevertheless, it is still not the time to turn bearish against sterling. The team at Deutsche Bank explains:

Here is their view, courtesy of eFXnews:

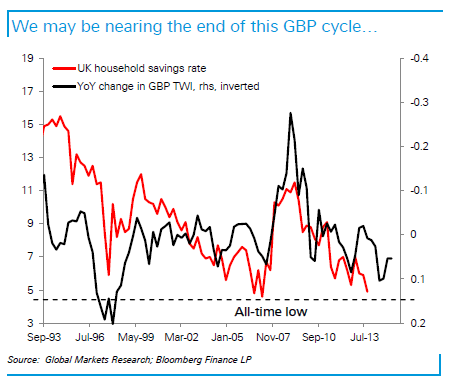

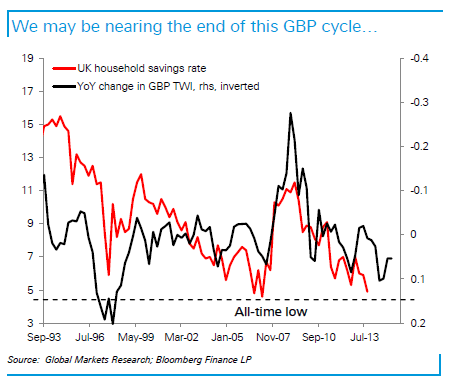

“There is a case to be made that the sterling rally is mature…Nevertheless, we don’t believe it’s time to turn bearish GBP just yet.

First, the risk remains that the Bank of England defies markets by tightening sooner than currently anticipated. Of the three tests set out by Carney in his July Lincoln speech, two are arguably being met (growth and labor costs), while there are clear signs of process on the third (core inflation). The market does not believe the BoE could tighten before the Fed, and has hence almost entirely priced out hikes for this year, with only 9bp now priced for February. But confidence may be misplaced. Past experience shows the MPC have moved before the FOMC, the BoE has explicitly said it will not wait on foreign central banks, and in accelerating wage growth there is at least prima facie evidence of a tight labor market, unlike in the US. At the very least, the risk reward appears skewed for earlier hikes. Hawkishness could thus help GBP against both EUR and USD, with the pound still very correlated to short-end rates.

Second, positioning has lightened significantly. Implied EUR/GBP shorts on the IMM are now at early 2014 levels. Volumes have also dropped off according to our DB Flow Report.

Third, underlying flows continue to be very healthy. The most high frequency data shows the UK has notched up 72bn of combined gilt and M&A inflows since March, in both cases accelerating from the first quarter. With gilt-bund spreads remaining at record highs and the investment environment favorable, there is no reason to think either should pause.

In short, there is not yet evidence that recent drivers of GBP strength have changed. Stay long.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.