- NZD/JPY bulls are in anticipation of the next bullish impulse.

- Bulls need to get through resistance structure first.

NZD/JPY is on the verge of a fresh bullish impulse in what appears to be a rounding bottom of a daily correction.

The following illustrates where the opportunity could arise on a lower time frame from where the price can be monitored for the optimal entry point.

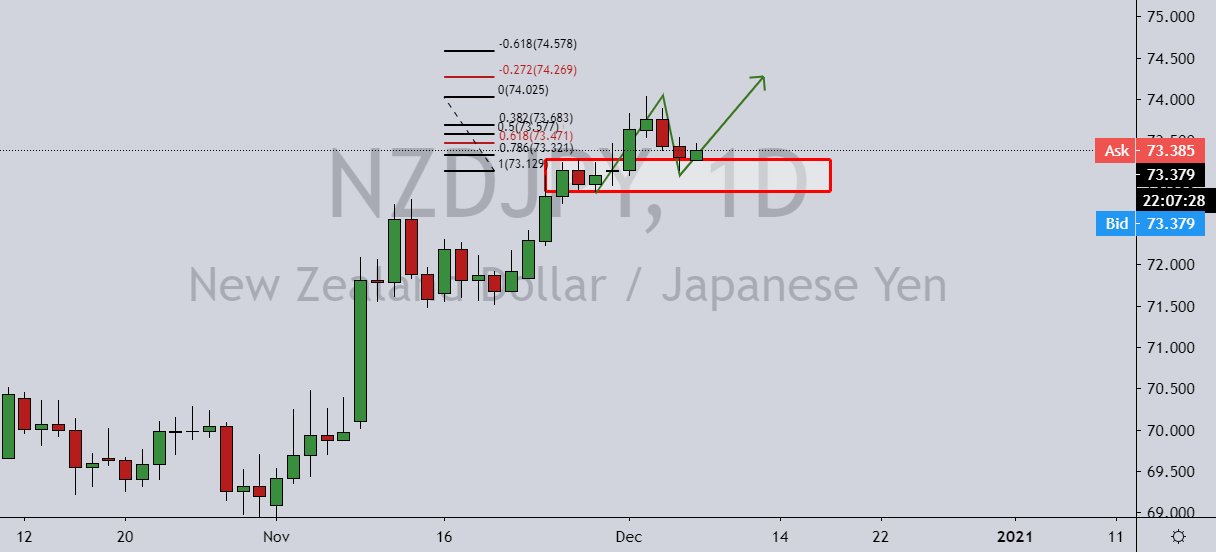

Daily chart

The price has corrected to test the prior resistance and would be expected to extend higher to print a higher high in the 74.20 psychological area that meets a -0.272% Fibonacci level of the correction’s range.

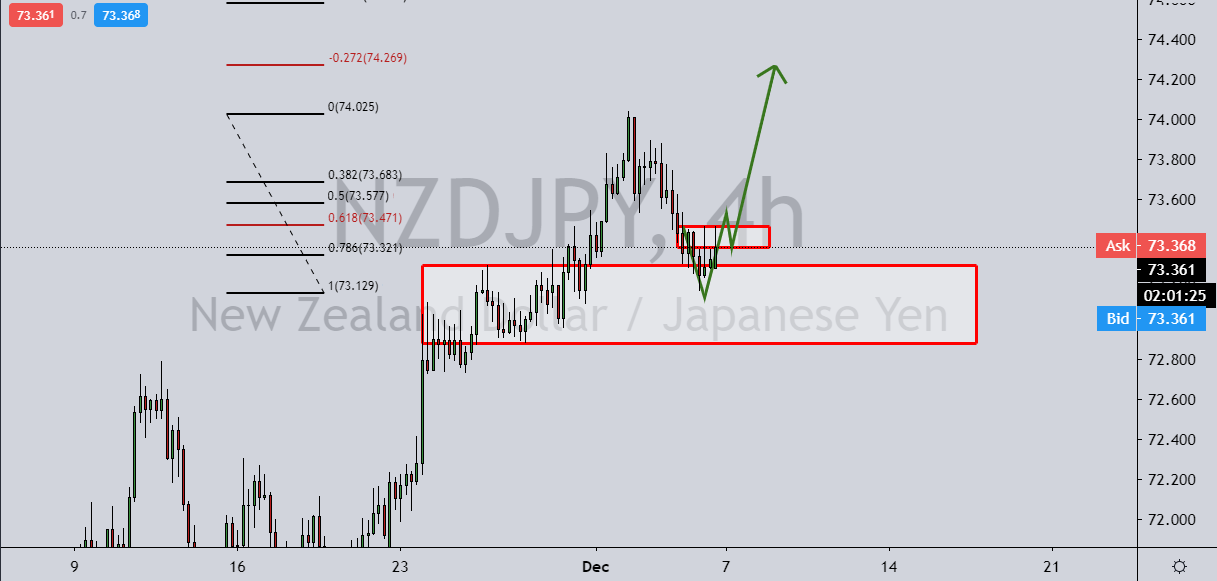

4-hour chart

From a 4-hour perspective, the bulls can be prudent to wait for a bullish environment and an initial break of resistance structure followed by a retest on a pullback.

In doing so, we will have a layer of confirmation in a bullish W-formation from which price action would be expected to result in an unside continuation towards the target.