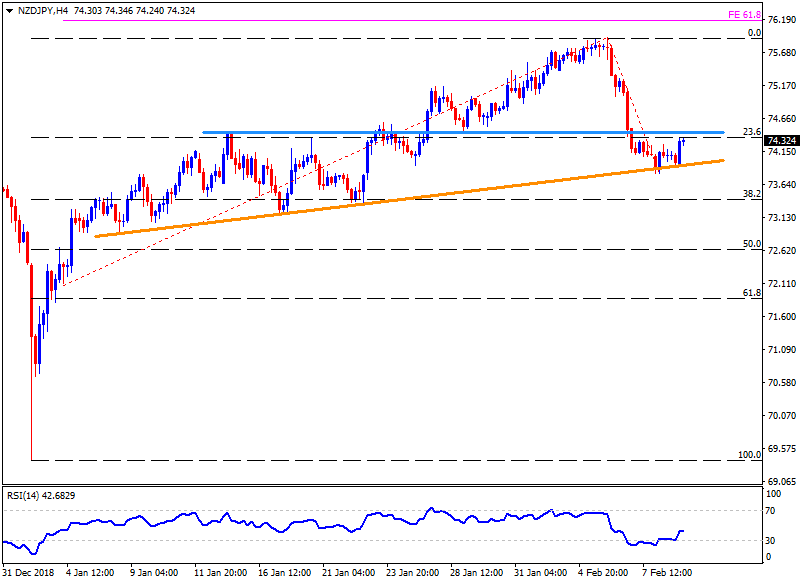

- The NZD/JPY pair again bounced off the month-long support-line during early Monday and is presently rising towards 74.45-50 resistance-area.

- During the pair’s extended up moves past-74.50, 74.70. 75.15 and 75.55 may offer intermediate halts during its rally to 75.90.

- In case prices slip under 73.90 support-line then the sellers can aim for 38.2% Fibonacci retracement of its recent surge, around 73.40.

- Assuming the Bears capacity to rule after 73.40, 72.90 and 72.40 may become their favorites.

- While gradually recovering 14-bar relative strength index (RSI) signal the pair’s rise, successful break of 74.50 seem prerequisite to justify the strength of momentum.

NZD/JPY 4-Hour chart

Overview:

Today Last Price: 74.34

Today Daily change: 23 pips

Today Daily change %: 0.31%

Today Daily Open: 74.11

Trends:

Daily SMA20: 74.54

Daily SMA50: 75.07

Daily SMA100: 75.12

Daily SMA200: 75.17

Levels:

Previous Daily High: 74.28

Previous Daily Low: 73.82

Previous Weekly High: 75.93

Previous Weekly Low: 73.82

Previous Monthly High: 75.54

Previous Monthly Low: 68.2

Daily Fibonacci 38.2%: 74

Daily Fibonacci 61.8%: 74.11

Daily Pivot Point S1: 73.86

Daily Pivot Point S2: 73.61

Daily Pivot Point S3: 73.39

Daily Pivot Point R1: 74.32

Daily Pivot Point R2: 74.53

Daily Pivot Point R3: 74.78