- The bird is flying towards a wall of resistance.

- All eyes are on the RBNZ and critical US data this week.

NZD/USD is around flat on the day as it heads into the Asian session, having travelled between a low of 0.7013 and 0.7049 overnight.

Traders are awaiting tomorrow’s the Reserve Bank of New Zealand’s event where a dovish outcome could weigh on the bird.

Meanwhile, US data is also a focus with Retail Sales and the Consumer Price Index (CPI) highlights the calendar, both of which could shake up markets a touch.

”The CPI probably surged, and not just due to energy prices this time. We caution against extrapolating, but the core reading will probably be boosted by a bounce in travel-related prices, most notably for airfares, hotels, and used cars,” analysts at TD Securities explained.

”We see some upside risk for rents as well. Changes to the seasonal factors could also be a source of strength, with payback later in the year.”

NZD/USD technical analysis

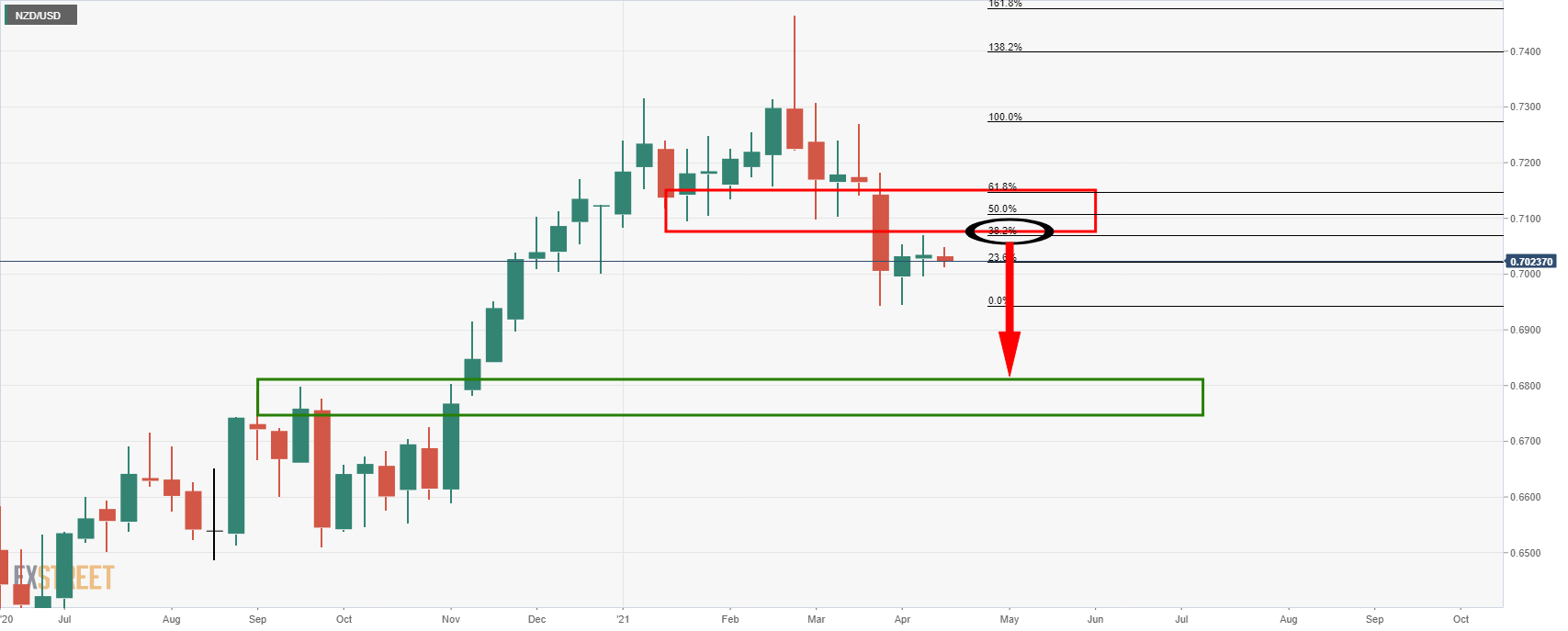

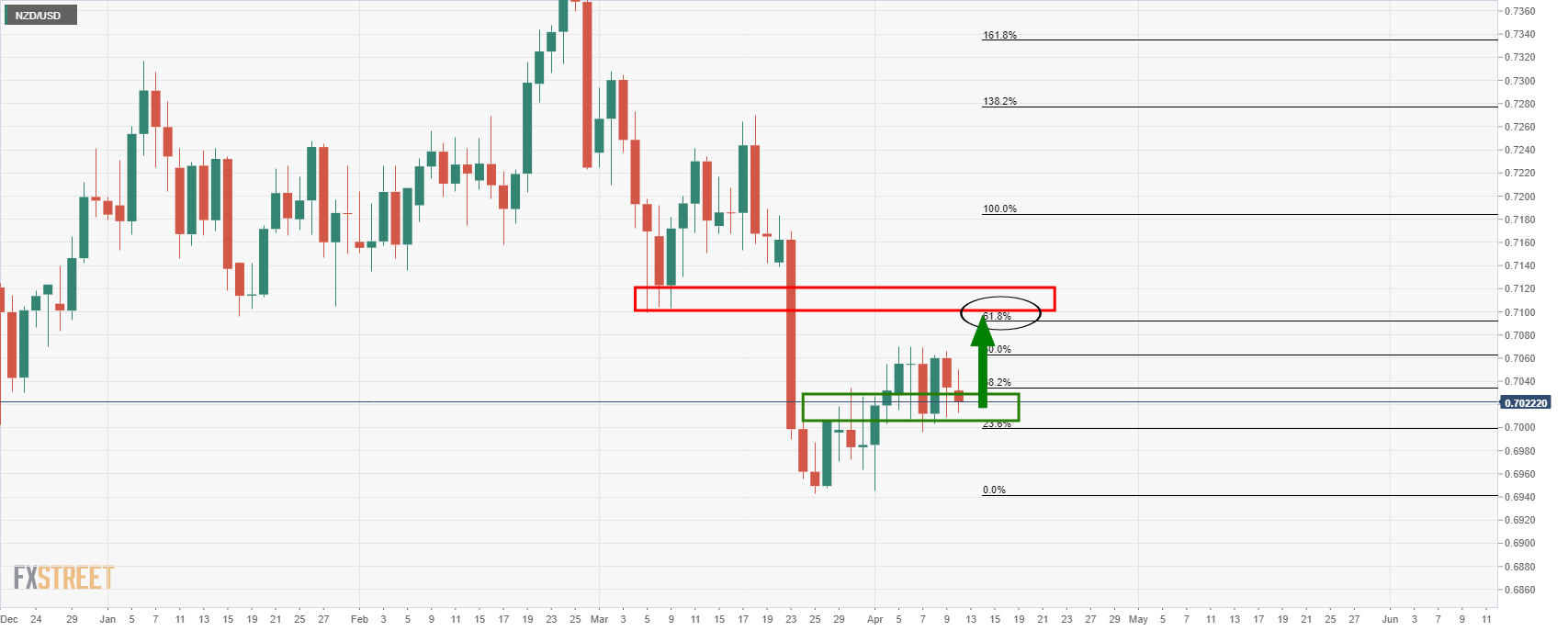

Meanwhile, there is a compelling downside bias on the weekly and daily charts according to market structure:

Weekly chart

Daily chart