- NZD/USD bulls jumped in to aggressively buy the dip when the pair hit lows of the day at 0.70025.

- The pair now trades back above the 0.7050 level but is still wounded on the day as a result of Covid-19 induced risk-off.

NZD/USD slumped as low as 0.70025 during the early part of European FX trade as the Dollar Index rallied briefly above 91.00 on safe-haven demand, with market anxiety triggered by the latest news of a much more transmissible strain of Covid-19 on the lose in the UK.

The outbreak of the new strain has triggered a return to the UK’s toughest lockdown restrictions for much of London and the South East and much of the international community has swiftly acted to isolate incoming travel from the country. However, the new strain, which is said to be 70% more transmissible, has already been detected in Italy and fears that the new strain could go global and trigger harsher global lockdowns has risk assets on the defensive. Separately, a lack of progress in Brexit negotiations is also feeding into the stronger buck, which is also weighing on the likes of NZD/USD.

However, NZD/USD continues to see a gradual recovery in recent trade and has now advanced back above the 0.7050s and into the 0.7070s, though still nurses losses of around 0.7% on the day.

Kiwi set to conform to global themes this week amid lack of notable domestic events

The New Zealand economic calendar this week is completely devoid of any notable, NZD market-moving events, which implies that price action in the likes of NZD/USD is likely to continue to be a determent of USD dynamics and global risk appetite. This, of course, has already been the case on Monday, and the passage of the outbreak of this new version of Covid-19 in the UK and across the world is likely to continue to garner the most attention this week.

Passage of another US fiscal stimulus package, which looks to have already been agreed on, seems priced in at this point and thus might not give risk-sensitive FX the likes of NZD much more of a boost. The same might also be argued about vaccine news, with markets not really caring much about the fact that the US FDA gave Moderna’s vaccine emergency use authorization last Friday after the market close.

Some might argue that given the distance between New Zealand and the new strain of Covid-19 discovered in the UK (and also the one discovered in South Africa), as well as the country’s past successes when it comes to keeping any outbreak under wraps, NZD might be well-positioned. With Australia currently grappling with its own mini-outbreak of Covid-19 in Sydney, NZD might be in a good position to see some outperformance.

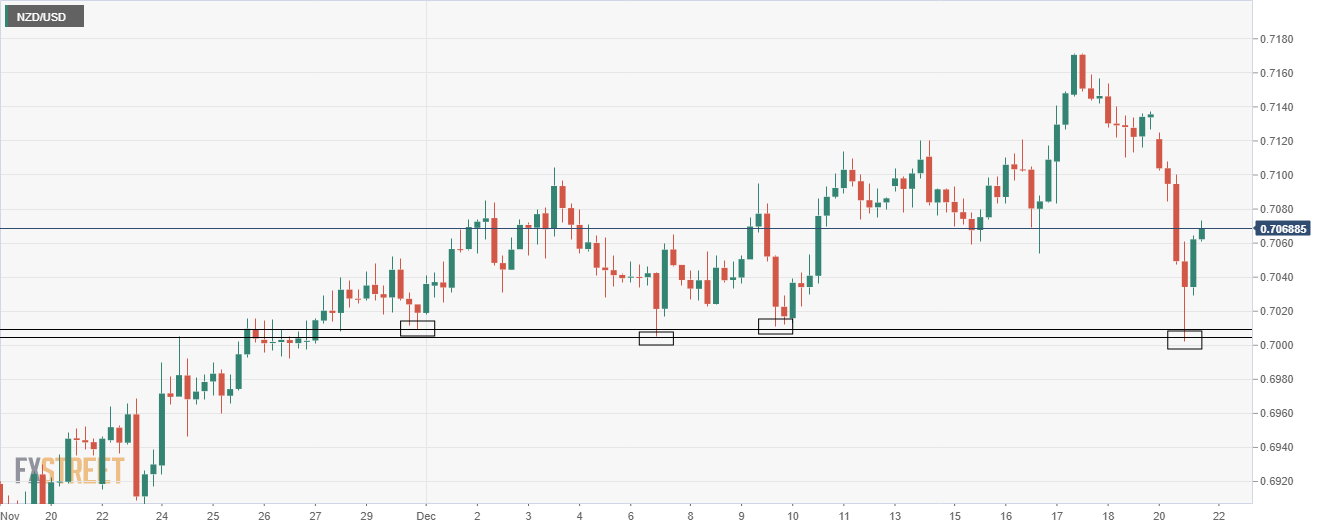

NZD/USD’s 0.7000 floor remains intact

NZD/USD bulls came in with force when the pair threatened a break below the psychologically important 0.7000 level during the European morning session. Thus, the level continues to prevail as support, as it did on 30 November, 7 and 9 December. Should risk aversion continue to worsen, however, the pair could see a break to the downside of this level, which would potentially open the door to a significant move lower given the lack of immediate levels of support.

The December 2018 high at 0.6970 would be one area to watch, as would the Q1 2019 double top around 0.6940. Below that, the next key support comes into play at 0.6800 (the July 2019 and September 2020 highs).

NZD/USD four hour chart