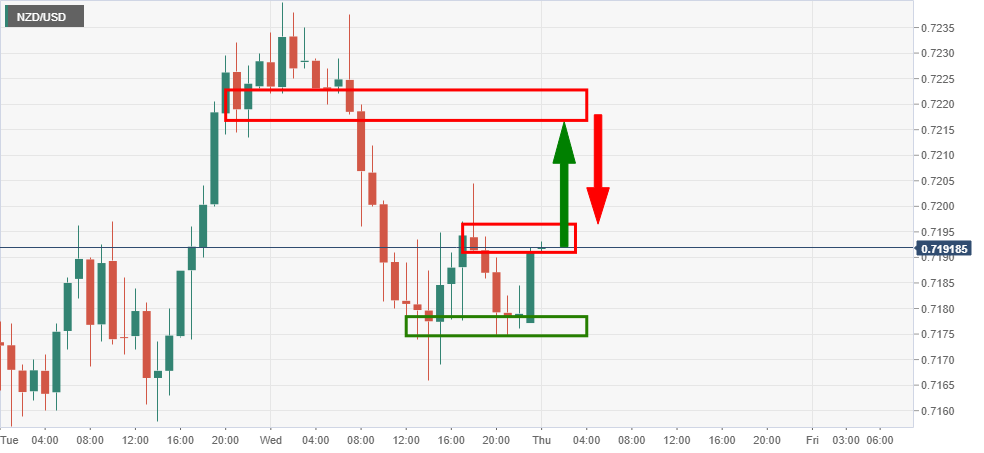

- NZD/USD carving out a bottom on the hourly chart.

- RBNZ in focus and could play out in the hands of the bulls.

NZD/USD is currently trading at 0.7191 between a low of 0.7173 and 0.7194 and attempting to regain ground, forming prospects of a double bottom.

It has been a volatile mid-week session with the kiwi pushed and pulled around an 80 pip range.

The main focus in the forex space has been with the US dollar, defying all the odds of a downside extension on the back of what is expected to be a super soft period for the greenback.

Markets are in anticipation of a prolonged bearish trend in the US dollar given the Federal reserve’s commitment to easier money and lower interest rates combined with a heavy fiscal stimulus package from the Democrats.

However, US yields have thrown the dollar bulls a lifeline and recent turmoil in European politics has dented the appeal of the single currency.

Domestically, the bird is in favour of the bulls.

”As we noted yesterday, we no longer expect the Reserve Bank of New Zealand to take the OCR negative, and at the margin that adds upside risks to the NZD, especially given the recent wave of positive data and sentiment,” analysts at ANZ bank said.

”But optimism is high now and we are at the end of a good run of seasonal strength, just as hopes of fiscal support are driving US bond yields higher, which speaks to USD support.”

RBNZ in focus

The analysts at ANZ have changed their call and now expect the OCR to be cut only one more time to 0.1% in May, reflecting a better economic outlook.

”That means we no longer expect a negative OCR unless downside risks materialise.

We could also imagine a scenario playing out where the RBNZ doesn’t need to cut again at all. However, the outlooks for employment and inflation will take some time to be assured.”

The analysts explained that this view suggests the RBNZ will remain cautious and more dovish than the market currently expects.

”As part of this, we expect that an emphasis that policy will remain expansionary for some time will be a feature of the February MPS, with an extension to the timeframe of LSAP purchases.”

NZD/USD technical analysis