- NZD/USD moves in on the key resistance, tempting bearish commitments.

- Risk-on environment favours the commodity complex.

NZD/USD is currently trading at 0.7165 between a low of 0.7114 and 0.7174 so far on the day.

Markets surged overnight with the S&P 500 hitting an all-time high as Joe Biden was sworn in as the 46th US President.

The commodity complex benefited when an upbeat Bank of Canada left rates on hold.

The central bank signalled ongoing loose monetary policy amidst a tough period for the economy, but said with vaccines being distributed and significant fiscal stimulus working its way through, the outlook is brightening.

The BoC acknowledged that the medium-term outlook is “now stronger and more secure than in the October projection, thanks to earlier-than-expected availability of vaccines and significant ongoing policy stimulus”.

Meanwhile, in the very short term, attention will be back on the Reserve Bank of New Zealand with the Consumer Price Index release tomorrow.

Further out, the Federal Reserve meeting next week will ”acknowledge the improved fiscal backdrop since the last meeting in mid-December,” analysts at ANZ Bank said.

”But no change in guidance is expected as the economy navigates the current COVID-driven weakness.”

NZD/USD technical analysis

As with the AUD/USD analysis, the bird had formed an equally compelling chart patter as follows:

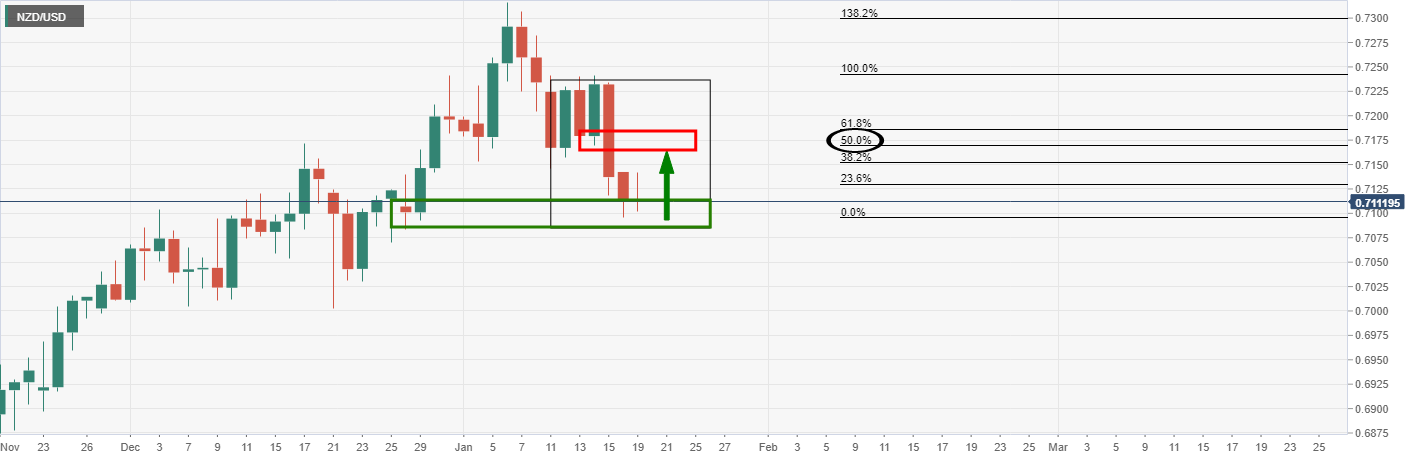

The price was expected to move in on the old support that would be presumed to act as new resistance.

Live market

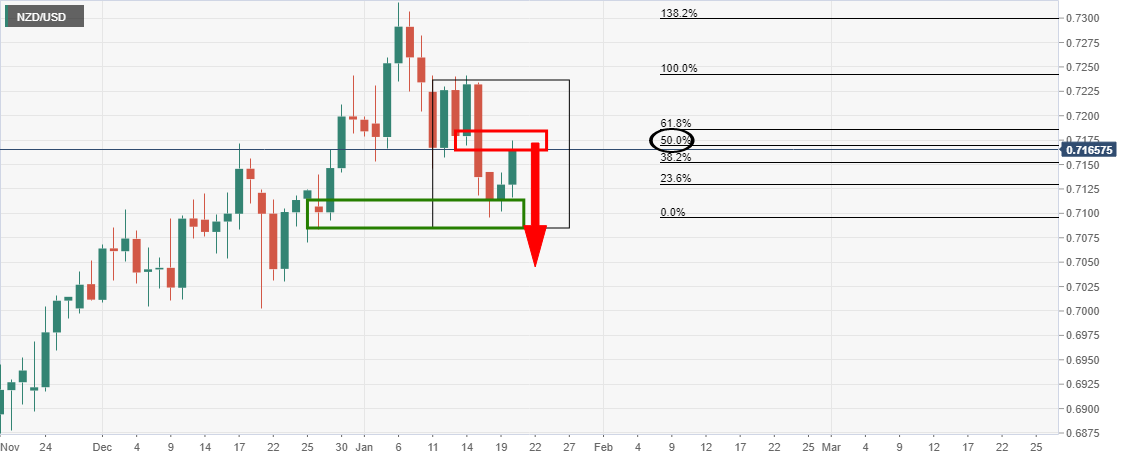

We have seen the 50% mean reversion and the expectations are now for a resumption to the downside.

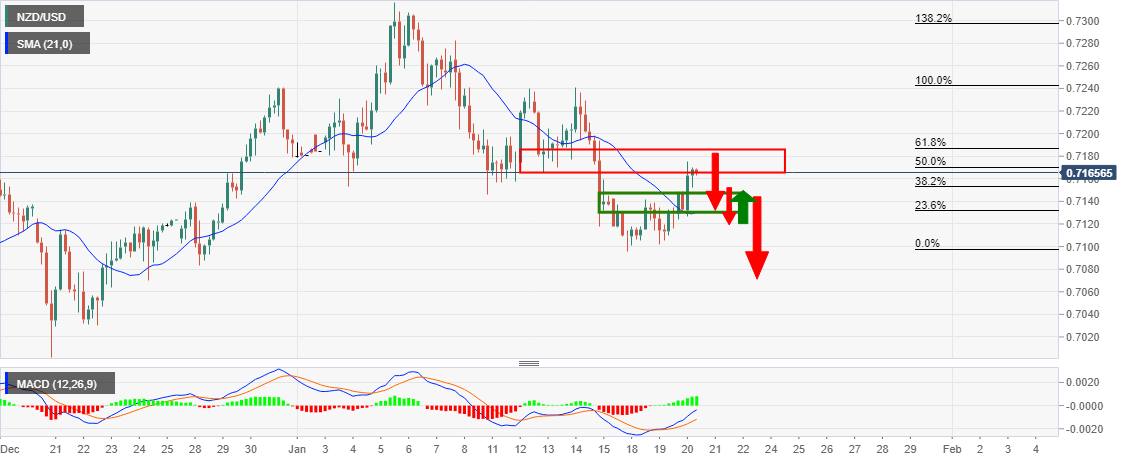

However, the 4-hour conditions are not bearish enough and the price can easily continue higher.

Bears will want to see price below the 4-hour 20- moving average and support structure: