- NZD/USD bulls eye a break of 0.7100 on US dollar weakness.

- The greenback has completed a significant correction and bears seek downside extension.

NZD/USD is currently trading at 0.7090 between a low of 0.7010 and 0.7091, higher by 1.08% as the US dollar’s bullish correction is faded.

USD has succumbed to worsening virus news and higher jobless claims on Thursday.

-

US: Labor market will remain under pressure in the short run – Wells Fargo

US jobless claims lifted with the four-week average now at its highest level in five weeks, consistent with new COVID restrictions taking a toll on the labour market.

The implications, therefore, is for December’s employment report to be even weaker than last week’s report for November which will put more pressure on policymakers to come up with another rescue package.

Most of the financial aid from the government has dried up so the forthcoming Federal Reserve meeting is to be a major event in the remaining weeks of the year.

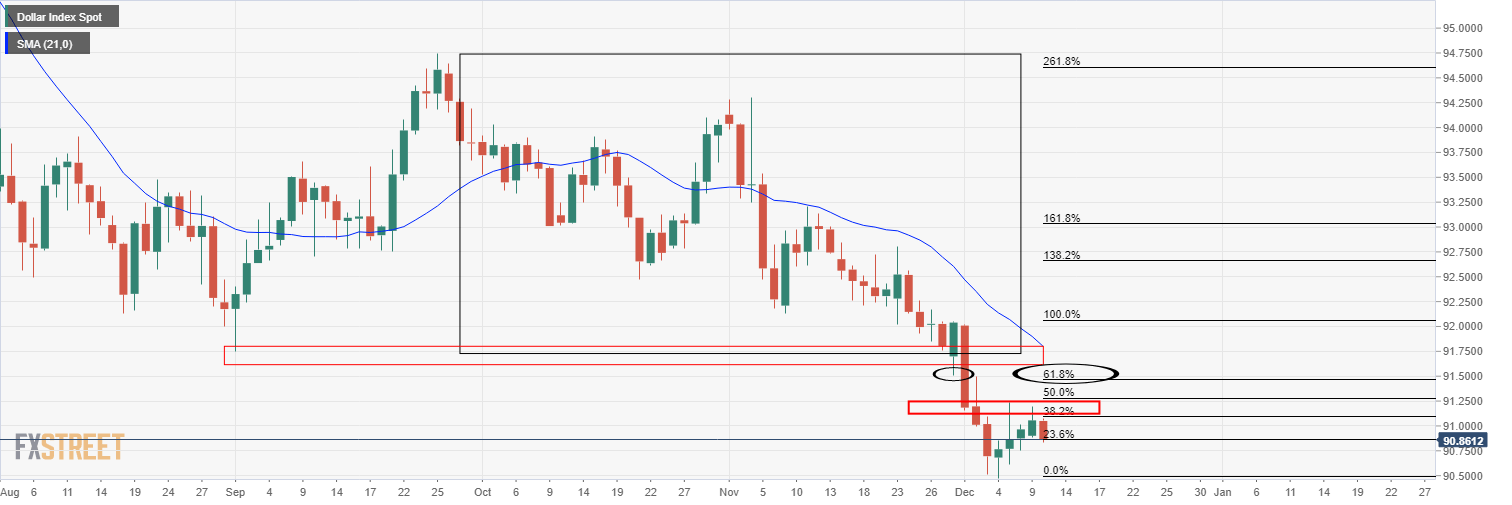

DXY daily chart

The daily picture for the DXY is turning bearish again following a 38.2% Fibonacci retracement of the prior bearish impulse.

As for the kiwi, ”the recent dip is a reminder that it’s not all one-way traffic,” analysts at ANZ bank said.

”But volatility and corrections aside, the overall backdrop for the NZD remains positive given the absence of the virus in the community and “normal” feel about life, albeit without hundreds of thousands of tourists who normally start to arrive about now.”

”The latter is something we harbour concerns about, but that won’t be evident for some time; in the meantime, the market is eager to look through it as vaccines are developed and deployed.”