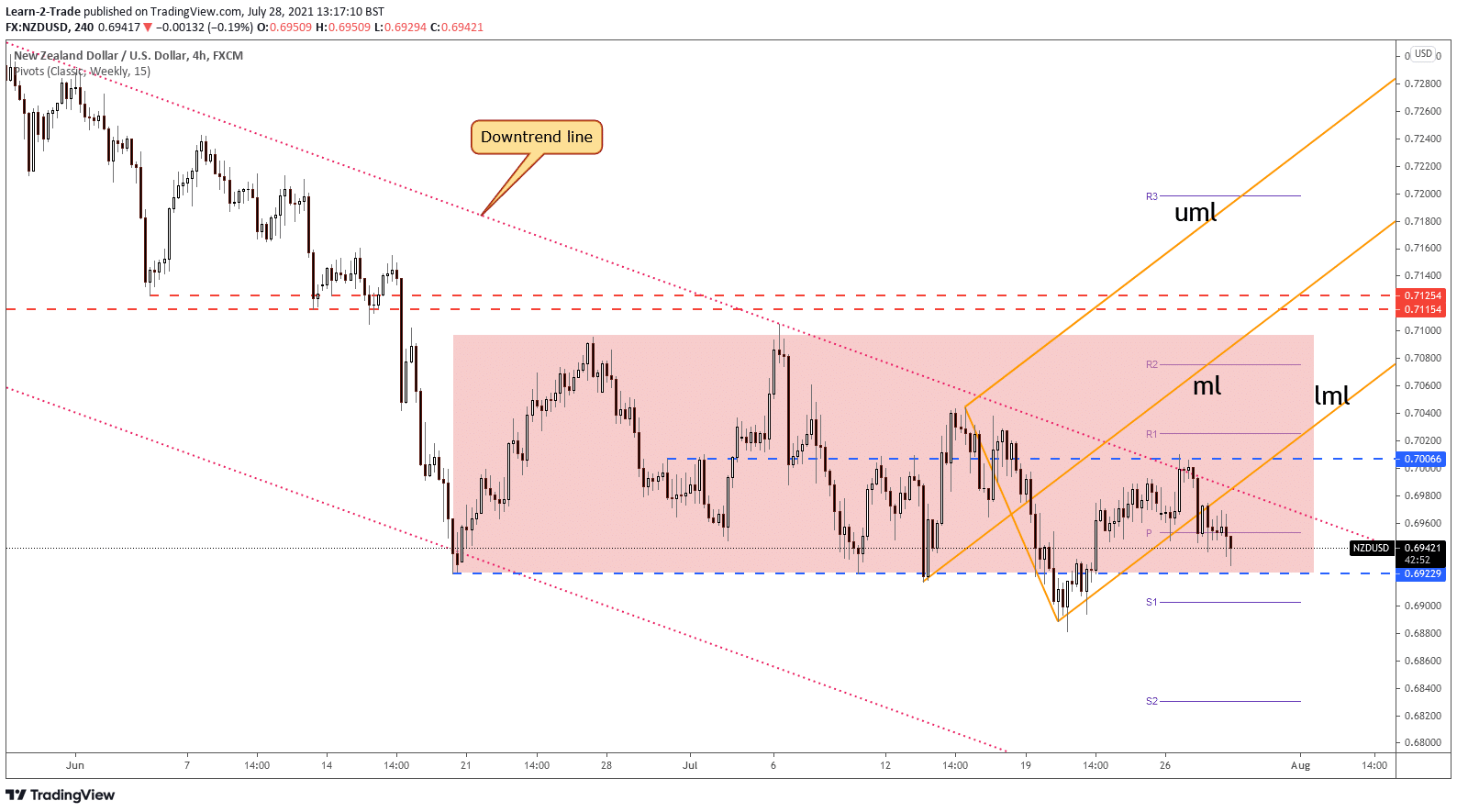

The NZD/USD forecast drops aggressively after retesting the down trendline. The US Dollar Index has managed to rebound, weighing on the Kiwi as well. It’s traded at 0.6932 level and is very near to 0.6922 static support. The bias is bearish, so a deeper drop is natural.

–Are you interested to learn more about automated trading? Check our detailed guide-

The sentiment could change after the FOMC meeting. The Fed is expected to keep its monetary policy unchanged. This scenario could disappoint the USD traders. Technically, the DXY has escaped from a rising wedge pattern. Now it tries to come back to retest the broken up trendline.

Definitely, the FOMC statement and the FOMC press conference could bring high volatility in the market. You should be careful around this high impact event. The traders are expecting the Fed to announce a potential rate hike in its next meetings. Anything could happen tonight.

The US Goods Trade Balance was reported at -91.2B while the Prelim Wholesale Inventories increased only by 0.8% versus 1.2% expected.

NZD/USD technical forecast: Key levels to watch

The NZD/USD pair has escaped from the ascending pitchfork’s body, signaling strong selling pressure in the short term. Also, it has ignored the weekly pivot point of 0.6953, signaling more declines ahead.

The outlook remains bearish as long as it stays under the down trendline. Dropping and stabilizing outside of the range’s body could really signal further decline.

–Are you interested to learn more about forex signals? Check our detailed guide-

As you can see on the H4 chart, NZD/USD has escaped from the current range. It has come back to retest the downtrend line before resuming its decline. We’ll have to wait for the markets to calm down after the FOMC before taking action again.

DXY’s drop could help the pair to start increasing again. However, the NZD/USD pair is in a neutral zone, so we’ll have to wait for a strong and fresh trading signal. Staying above 0.6922 could announce a downtrend line breakout.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.