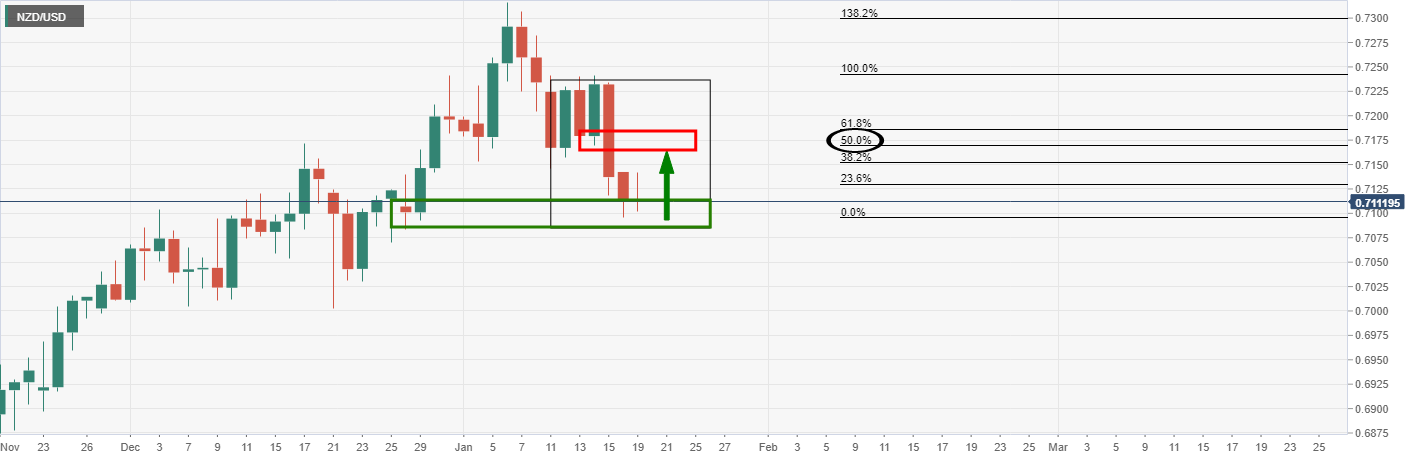

- NZD/USD stalls at a familiar demand area, eyes on a 50% mean reversion.

- Markets await the US Presidential inauguration immersed in a risk-on theme.

NZD/USD is trading at 0.7111 and correcting the latest bearish impulse having travelled between the low of 0.7102 and 0.7140.

The US dollar has extended its downside correction taking the DXY down over 0.28% at the time of writing in a risk-on environment as investors cheered comments from US Treasury Secretary nominee Janet Yellen.

The sentiment for the need for major fiscal stimulus as helped markets to move higher which has sunk the greenback which is correcting the 2% rise so far in 2021.

Yellen, appearing before the Senate Finance Committee on Tuesday, urged lawmakers to “act big” on the next coronavirus relief package.

”Janet Yellen’s confirmation hearing clearly indicated the two-stage approach that the new administration’s economic policy will take. The first is to ensure the recovery from the pandemic. The second is to invest in infrastructure, digital and the environment, amongst other areas,” analysts at ANZ bank explained.

Meanwhile, markets await the US Presidential inauguration tomorrow in anticipation of phase two of Biden’s economic proposals, to be announced next month.

”For the FX markets, expectations of US reflation are USD negative as they reduce safe-haven demand for the currency,” the analysts at ANZ bank said.

”However, seesawing between expectations of reflation and current soft economic data will probably continue for a while longer, limiting NZD upside in the near term.”

NZD/USD technical analysis

As with the AUD/USD analysis, the bird is correlated and has formed an equally compelling chart patter as follows:

The market would be expected to return to test the prior support in a 50% mean reversion.