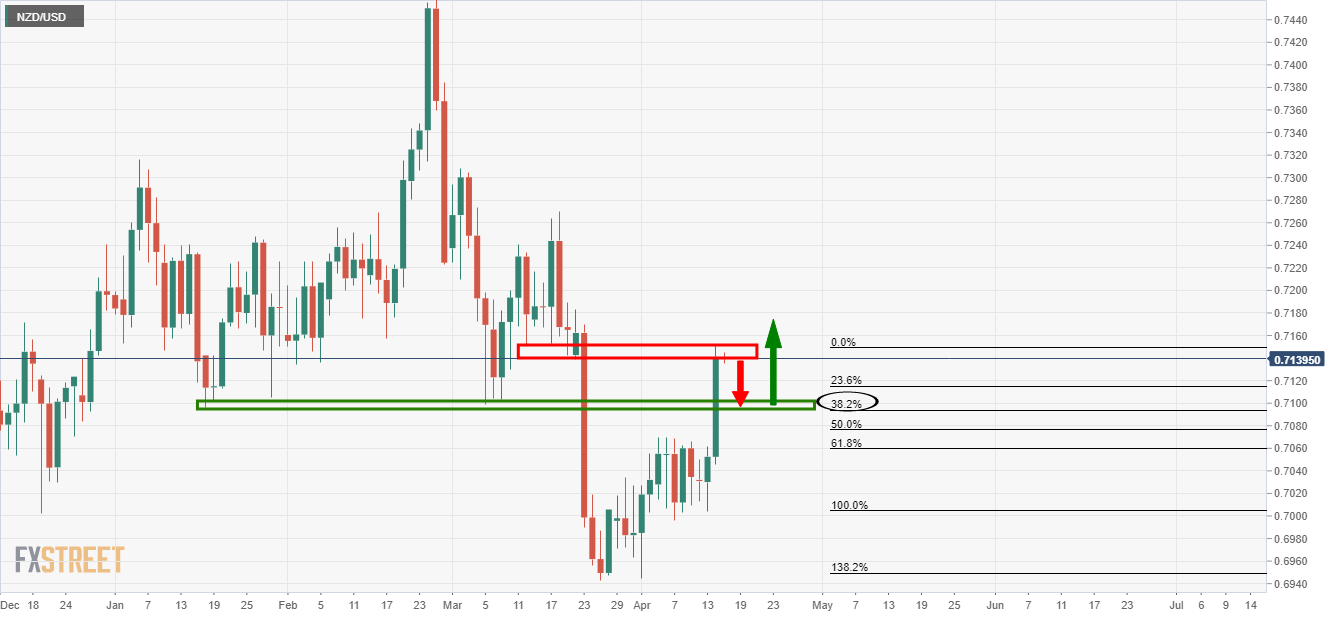

- NZD/USD tops out and the focus is on the downside from daily resistance.

- US dollar remains on the backfoot as Fed heads fan the dovish flames.

NZD/USD is currently trading at 0.7141, virtually flat on the day having travelled from a low of 0.7135 and reaching a high of 0.7143.

Yesterday’s Reserve Bank of New Zealand’s MPR has been brushed aside and instead the market is more focused on the ongoing USD weakness.

The Federal Reserve Chairman Jerome Powell said in remarks at the Economic Club of Washington it was highly unlikely the central bank would raise interest rates before the end of 2022.

The Vice-chair, Richard Harris Clarida echoed such rhetoric who said rates will be lower for longer and that the Fed will delay lift-off.

Meanwhile, the Fed said in its latest “Beige Book” that the US recovery accelerated to a moderate pace from late February to early April.

By the end of the day, the benchmark 10-year notes rose 1.3 basis points to yield 1.6359%. The dollar index fell to 91.5740.

”The NZD should be well supported by commodity prices and the global cyclical uplift – we firmly believe that, but USD weakness over the past few weeks does feel a bit extreme given the decent state of recent data. Time will tell,” analysts at ANZ Bank explained.