- The NZD/USD pair continues to gain, but it’s almost to reach strong upside obstacles.

- DXY’s further drop helped the price rise even if the New Zealand data came in worse than expected.

- A temporary decline or a minor consolidation could help us to catch a new upwards movement.

The NZD/USD price rallies at the time of writing as the Dollar Index resumes its downside movement. The price is trading at 0.7063 level, and it could hit strong upside obstacles soon. The USD needs strong support from the US economy to be able to recover after its current sell-off.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

The outlook is bullish, so a temporary decline could help us to catch new upwards movements. The US will release the CB Consumer Confidence later today, which is expected to drop from 129.1 points to 122.9 points in August. This could be bad for the greenback ahead of the US NFP. Moreover, the Chicago PMI could drop from 73.4 to 68.0 points. A deeper drop could weaken the dollar as well. The US HPI and the S&P Composite-20 HPI indicators will be published as well, but I don’t think that will impact the NZD/USD pair.

New Zealand has released the ANZ Business Confidence and the Building Consents. Unfortunately, the economic indicators have come in worse than expected. Still, the NZD/USD pair gains only because the Dollar Index plunges.

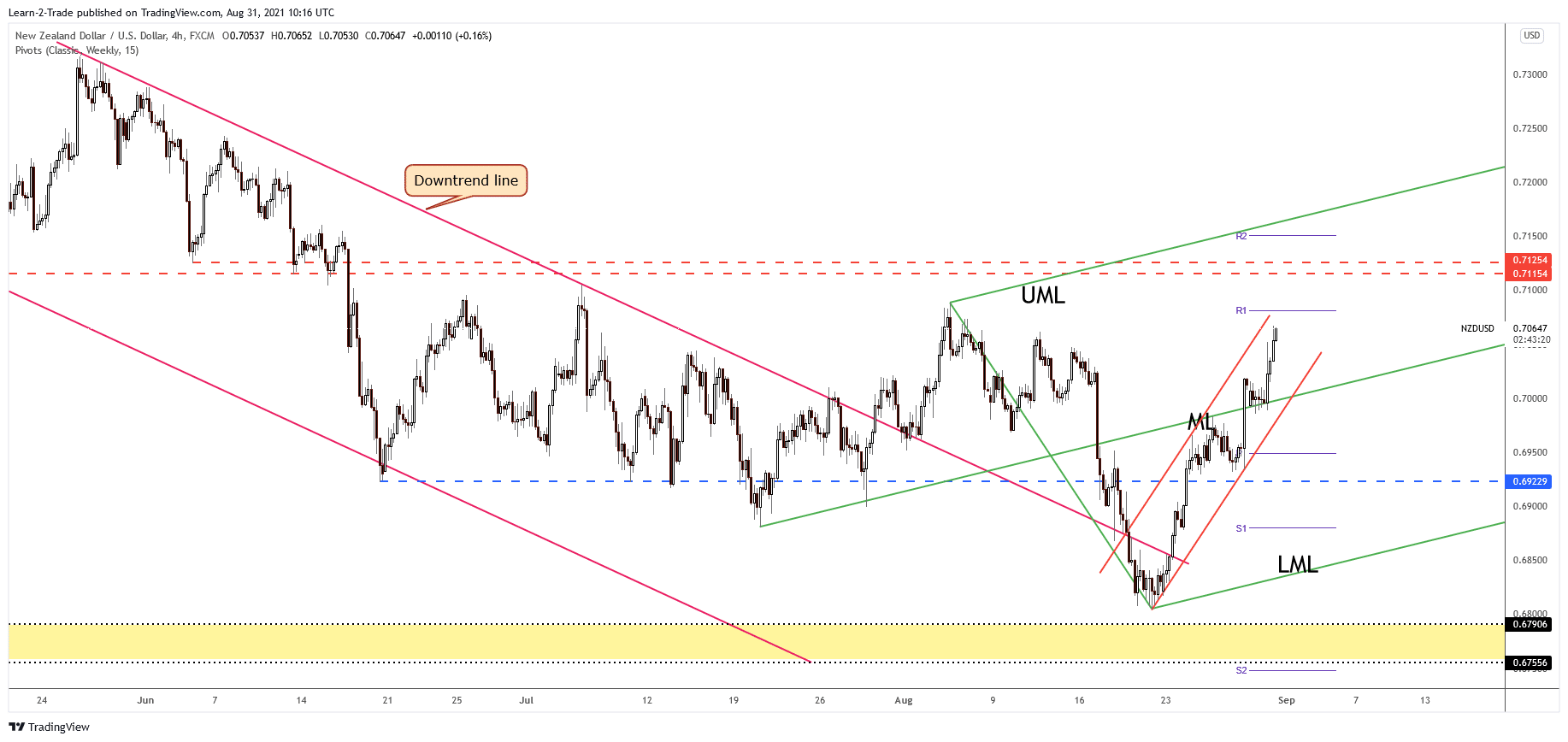

NZD/USD price technical analysis: Up channel remains intact

The NZD/USD pair has resumed its rally after jumping and stabilizing above the ascending pitchfork’s median line (ML). I’ve told you in my previous analysis that the price could register an amazing rally if it takes out the dynamic resistance represented by the median line (ML).

–Are you interested to learn more about making money in forex? Check our detailed guide-

It goes higher within an ascending channel. In the short term, the bias will be bullish as long as it stays within this pattern. The immediate resistance level is seen at the weekly R1 (0.7081). Also, the channel’s upside line stands as a dynamic resistance.

Technically, the NZD/USD pair could resume its rally as long as it stays above the ascending pitchfork’s median line (ML). So, a temporary decline after the current bullish fly won’t affect the upside scenario. 0.7115 – 0.7125 area represents an important supply zone, a resistance zone. In addition, 0.7100 is seen as an upside target as well. Personally, I would like to see a temporary decline of a minor consolidation before the price reaches these major obstacles.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.